One of the biggest issues many companies face is being short on Cash. The Cash Conversion Cycle measures cash that is tied up in a company and if monitored and reduced can extract cash out of a business to avoid these shortages.

As important as it is, due to the complexities of generating the Cash Conversion Cycle (CCC) companies seldom measure it.

The Cash Conversion Cycle is a measurement of multiple Cash Flows. The description I like to use is “For every Dollar you put into your business for a Product or Service, how long does it take to get it back out?”

The CCC is a measure of cash flow around Receivables, Payables, and Inventory reflected within the same time period. The Cash Conversion Cycle Measures how long a firm will be deprived of cash if it increases its investment in resources in order to support customer sales. It is thus a measure of liquidity risk.

However, shortening the Cash Conversion Cycle creates its own risks: while a firm could even achieve a negative Cash Conversion Cycle by collecting from customers before paying suppliers, a policy of strict collections and lax payments is not always sustainable.

The equation for the Cash Conversion Cycle is:

Receivable Days + Inventory Days – Payable days = CCC

Receivable Days are the number of days on average your customer is paying you after you have delivered your product or service.

Inventory Days are the number of days of inventory remaining for your product.

And Payable Days show how long on average it takes the company to pay it’s suppliers for materials or finished goods.

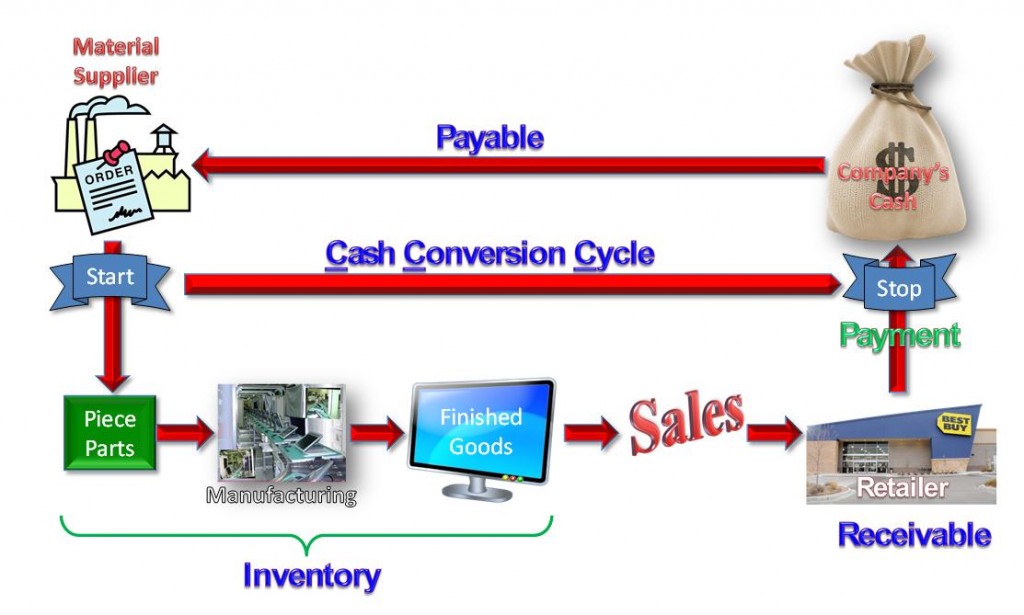

The following flow diagram is a depiction of the typical flow in a manufacturing company:

The Cash Conversion Cycle starts when the supplier ships material to the company and ends when the customer pays the company what is owed. Delay in paying the supplier for the materials to manufacture the product shortens the total Cash Conversion Cycle as the equation states.

When looking at the Balance Sheet where Receivables, Inventory, and Payables are found, you only get the amount of money in those accounts. Certainly if the account is increasing or decreasing you get a sense of whether are you improving or not, but to understand the number of days that are needed to calculate the Cash Conversion Cycle for those accounts, additional information is required.

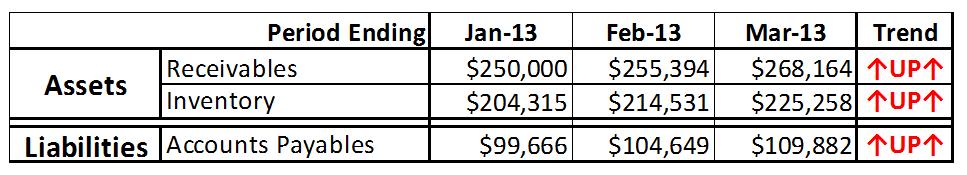

Looking at an example of a small part of your Balance Sheet shown below, all these accounts are increasing. For receivables does that imply your customers are paying later each month? For Inventory does that mean the company is building more finished goods? And for payables, does that mean the company is slowing down payments to their suppliers? Well that would only be a guess.

What you need to know to complete the calculation is:

- the consumption rate of your Inventory, and

- the payment rate of your customers, and

the payment rate to the company suppliers.

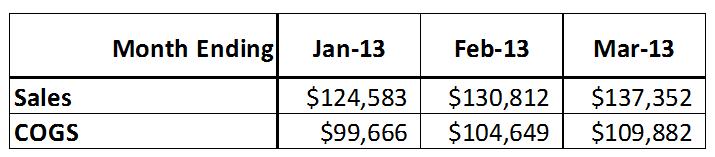

This information can be found only on the Income Statement. What follows (immediately below) is the part of the Income Statement that supplies this data:

The missing information is Sales which generates the Receivables. COGS is the consumption of Inventory, and COGS also reflects payables. Before we get into the details of the formulas, I will walk through a logical example. If Receivables was steady at $100,000 and the sales was also $100,000 each month, that would imply that the customer is paying in 30 days. If the Receivables are $200,000 and the sales are still $100,000 a month that would imply that the customer is paying in 60 days.

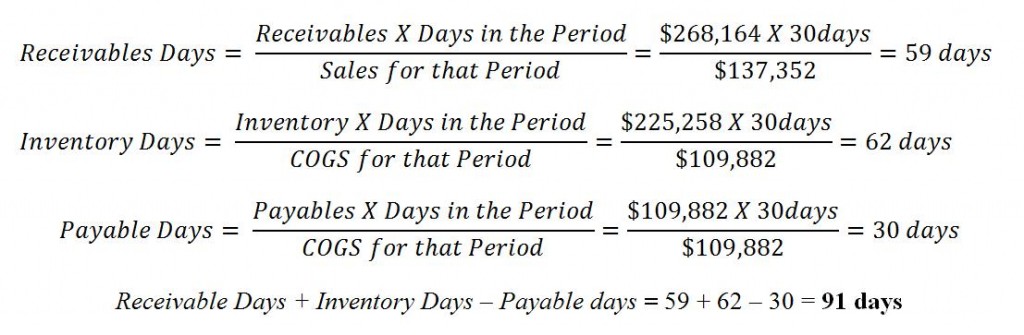

The equations for these three elements of the Cash Conversion Cycle are as follows:

So as can be seen by this example company, they have 3 months of cash tied up in their business. Cash that would be in the bank or being used to fund other things.

To give you an idea on what this is costing this company, if their receivables were reduced to 30 days as well as their inventory that would equate to nearly $250,000 of cash opportunity. That is pretty significant for a less than $2M annual sales business. The math to get this figure will be covered in another article.

Measuring the Cash Conversion Cycle for a business is a critical metric companies should use often. Because of the complexity of using both the Income Statement and the Balance Sheet to derive the results, companies seldom do the work to see where they stand, but finding this hidden cash in a business can be the difference in a company being successful or closing their doors.

Terrific post but I was wondering if you could write a litte

more on this subject? I’d be very thankful

if you could elaborate a little bit further. Cheers!

Yes, I strongly agree with what you said. I also believe that cash is definitely one of the main problem why a business fail. I think that we must have to secure our business financing in order to grow our business. Thanks for sharing this article.

Yes, I totally agree with what you said. I also think that a lot of businesses suffer from financial issues. I think that it’s very important for us to handle our business financing in order for our business to keep on operating. Thanks for sharing this article.

Yes , I strongly agree with what you said. I think that cash is very important for business and a lot of businesses suffers from money issue. I think that it’s very important for business owners to have enough knowledge on how to fund business.

Thanks for sharing this article. I think that I need to know how to calculate Cash Conversion Cycle because I have a business. This article is a big help for my business accounting.

This is where a line of Credit with the bank can be very helpful. A company growing is a good thing and a Bank will understand that if the company can explain that with their financials. The Financial Gap part of Electronic Financial Officer can help you explain this to a banker to get a line of Credit or even a loan.

Factoring companies can be expensive whereas interest rates on loans should be lower.