note: The article below was adapted and included in our monthly letter to our Profit Gap clients.

Find cash in your company: maximize YOUR Working Capital

We have been intrigued by the benefits to companies from improved performance of their working capital.

This article’s thoughts are mostly focused on inventory management and its role in Working Capital generation.. Future articles will focus on payables and receivables and their role in working capital.

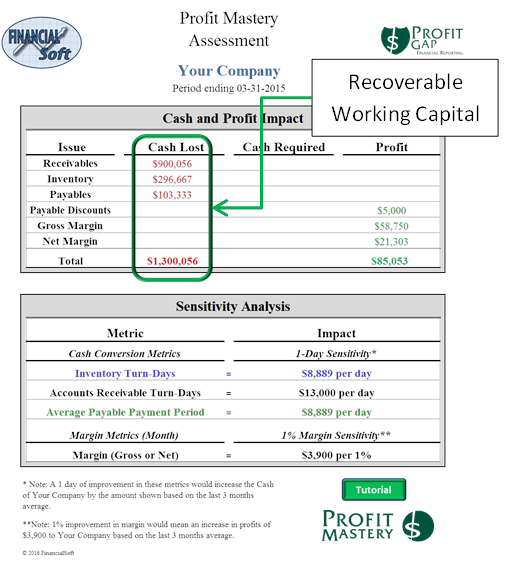

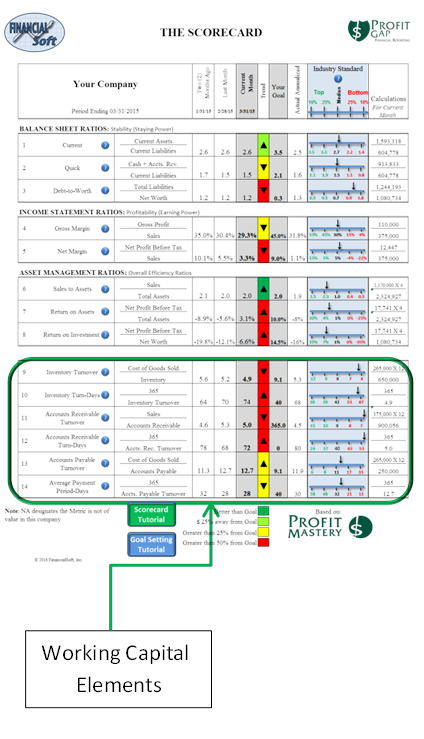

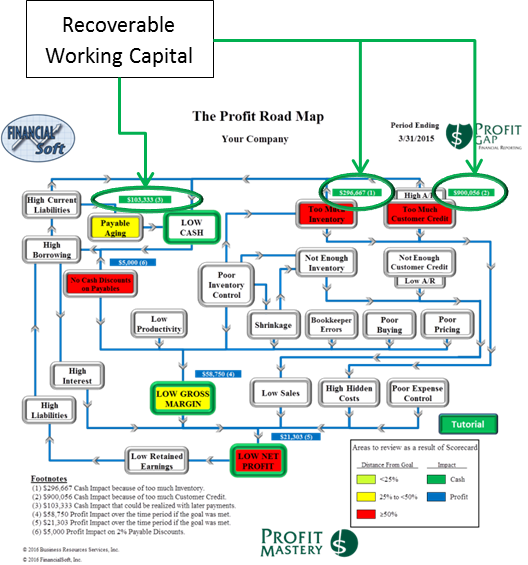

As you may know, Profit Gap addresses this subject directly in the scorecard ratios for inventory, payables and receivables. The monetary values on both the Roadmap and Profit Mastery Assessment (circled below) are actually designed to focus on the importance of working capital and how to find it in your business.

Working Capital is the money in the “Cash” line of your Balance Sheet. This is the money left over after you have paid all the expenses to operate the company, so it is excess that can be used for many purposes. Profit Gap finds opportunities to increase Cash or working capital, by reducing Inventory and Receivables and increasing Payables. The monetary values found on the Profit Mastery Road map and PMA pages of Profit Gap indicate the opportunity in each of these categories compared to goal.

Working Capital is the money in the “Cash” line of your Balance Sheet. This is the money left over after you have paid all the expenses to operate the company, so it is excess that can be used for many purposes. Profit Gap finds opportunities to increase Cash or working capital, by reducing Inventory and Receivables and increasing Payables. The monetary values found on the Profit Mastery Road map and PMA pages of Profit Gap indicate the opportunity in each of these categories compared to goal.

Managing a company’s working capital is not an easily understood task for most executives…the financial analysis requires time and a comfort that many find intimidating. Also, since working capital does not appear on the income statement, it doesn’t directly affect earnings or operating profit — the measures that garner the attention of most management executives. While most business leaders concede that working capital is important, our experience is that few know how it actually works, much less how to take advantage of working capital that is most likely available to the company thru better management.

That is quite a missed opportunity — and it has implications throughout the company. Working capital can amount to as much as several months’ worth of revenues, which may not be trivial. Improving its management can be a quick way to free up cash. Even small companies (1 to 5 M annual revenues) can generate tens of thousands of dollars of cash impact within 60 to 90 days without increasing sales or cutting costs.

For distressed companies, Working Capital improvement can be a lifeline. For healthy companies, the windfall can often be reinvested in ways that more directly affect value creation, such as growth initiatives or increased balance-sheet flexibility. Moreover, the process of improving working capital can also highlight opportunities in other areas, such as operations, supply-chain management, procurement, sales, and finance.

Of course, not all reductions in working capital are beneficial. Too little inventory can disrupt operations. Stretching supplier payment terms can leak back in the form of higher prices, if not negotiated carefully, or unwittingly send a signal of distress to the market. But managers who are mindful of such pitfalls can still improve working capital by setting incentives that ensure visibility, collecting the right data, defining meaningful targets, and managing ongoing performance.

Pay attention to metrics to elevate visibility

Working capital is often under managed simply because of lack of awareness or attention. It may not be tracked or published in a way that is transparent and relevant to employees, or it may not be communicated as a priority. In particular, working capital is often underemphasized when the performance of a business — and of its managers — is evaluated primarily on income-statement measures such as earnings before interest, taxes, depreciation, and amortization (EBITDA) or earnings per share, which don’t reflect changes in working capital.

What actions should managers make, beyond communicating that working capital is important? In our experience, the selection of metrics to manage the business and measure performance is especially important, because different metrics will lead to different outcomes. (Note: Profit Gap reports do track the important metrics. As suggested, sharing these with relevant staff may be a beneficial practice.)

Data Collection

Many companies don’t systematically track or report granular data on working capital. That almost always indicates an opportunity to improve. For example, if managers at a manufacturing company can’t quickly determine how many days their current inventory will last at each location and stage of production — raw materials, work in progress, and finished goods — then they can’t be managing it well.

The good news for Profit Gap users is that working capital metrics are clearly identified. Indeed, they are one of the most important metric segments of the Scorecard and Roadmap (note: refer to the graphics at the beginning of this letter). Without such data, companies may be making erroneous decisions elsewhere.

Getting working capital data into a consistent and usable format the first time can be tedious, but for purposes of this document, it must be pointed out that Profit Gap automatically pulls this data from your QuickBooks file, saving a great deal of time and tedium.

Your Profit Gap reporting system also stresses the importance of Goal setting and maintaining momentum…run your Profit Gap reports every month and manage to your goals. The point here is that your Profit Gap report, based on the system taught by Profit Mastery, gives you a financial management solution for your company that is utilized on a larger scale for some of the best managed companies on the planet.

Note: This article focused mostly on inventory as one of the key working capital elements. In other articles, we focus on a discussion about Payables and receivables managing each of these optimally can generate positive impacts on Cash Flow and Working Capital.

FinancialSoft is dedicated to helping small businesses prosper. Its Financial Reporting Systems provide business intelligence to help company owners increase Cash Flow and Profits thru a better understanding of their financial statements and how to use them to guide company decisions.

Recent Comments