Improving Your Business Efficiency with the Cash Conversion Cycle

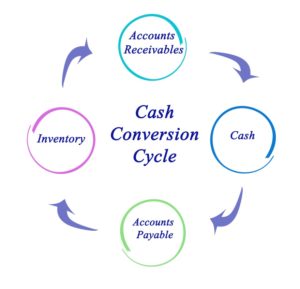

When it comes to Profit Gap, “efficiency” is managing your Cash Flow. This is accomplished by managing these three accounts:

- Receivables (AR): what your clients owe you

- Inventory: Product you have in house

- Payables (AP): What you owe to your suppliers

Profit Mastery quantifies these three accounts by measuring them against your Sales and COGS levels found on the Income Statement or P&L.

Of the 14 metrics found on the Profit Mastery Scorecard, 6 (43%) are dedicated to these efficiency metrics emphasizing their importance. When measuring these metrics you can then measure having too much or too little of each of these accounts. The relevant Profit Mastery metrics as included on the Profit Gap Scorecard are:

- Turnover (how many times is the value in this account turned in a year) and

- Days (how many days of each of these accounts does your business carry).

For example:

- Receivable Turn-over 12 turns is the same as 30 Days

- Inventory Turn-over 24 turns is the same as 15 days

- Payables Turn-over 6 turns is the same as 60 days

These three accounts together provide you with another metric called the Cash Conversion Cycle or CCC for short. The equation is:

Receivable Days + Inventory Days – Payable Days = CCC

Optimizing this equation to the lowest possible levels improves your company’s efficiency. A positive value means you need to invest working capital into your business for its operations. A value of zero or lower (Negative) means that you do not need to invest any working capital to acquire inventory to operate your business.

For Retailers, often the biggest investment in their business is their Inventory of products they sell to their customers. Minimizing cash investment into their inventory has major impacts on their success. Many large retailers actually have a negative Cash Conversion Cycle! How can they do that?

Well, let’s run through an example… large retailer is selling consumer electronics sourced by many suppliers. The key to their success depends in large part on efficient inventory management – to have enough inventory to satisfy their customers, yet pay for the inventory after it has actually been sold to their customers. This retailer’s metrics for the three elements in the Cash Conversion Cycle are as follows:

- Receivable Days = 0 as the customer must pay before they leave the store or COD

- Inventory Days = 30 days

- Payable Days = 45 days They demand from their suppliers 45 day payment terms which most supplier accept

Now for the calculation:

| Receivable Days | + Inventory Days | – Payable Days | = CCC |

| 0 Days | + 30 Days | – 45 Days | = -15 Days |

What this represents is this retailer gets paid by his customer before they even have to pay their suppliers – meaning they are funding their operations with the supplier’s credit.

We know that for a small business owner to get to a negative Cash Conversion Cycle may be unrealistic, but getting close to zero will significantly improve your efficiency and increase your available Working Capital.

Profit Gap’s automation makes calculating this complex formula easy so you can get down to the work of improving your Cash Conversion Cycle.

Recent Comments