This is the last of a series of Profit Gap articles re Working Capital. Previous articles discussed working capital generally, and specifically the relationship between working capital and payables and Receivables. What follows is a brief discussion regarding inventory as the third element of working capital.

To begin with, for this article we had two prospective views as working titles for this subject:

How Profit Gap helps with inventory management and identifies opportunities to improve your Working Capital balances.

OR,

How Profit Gap can help grow your business – without increasing your liabilities

Our intent here is to demonstrate how your Profit Gap financial reports can be a useful tool for bringing focus to inventory management while it helps strengthen the company’s Balance Sheet…so let’s leave the two title thoughts in place and proceed:

Arguably, inventory is one of the most challenging working capital metrics to manage. Profit Gap addresses inventory directly with two of the Scorecard metrics.

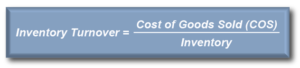

- Formula for the Inventory Turnover Profit Gap calculation :

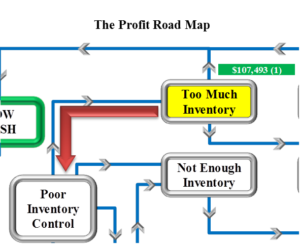

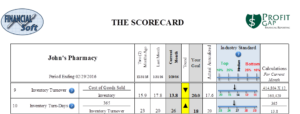

In this example, both the Scorecard and the Profit Road Map call attention to the fact that this company is turning inventory over annually 6.2 turns less than goal (Scorecard) – an annual cash impact of $107,493 (Profit Road map & PMA).

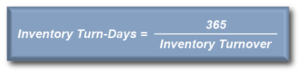

Formula for the Profit Gap Inventory Turn-Days calculation:

In this example, the Scorecard shows that this company is 8 days over its goal of turning inventory over every 30 days at a cost to the company of $15,728 per day (Profit Mastery Assessment).

For clarity, it should be mentioned that the two formulas illustrated above are really the same thing – one is just the inverse of the other. Some businesses like retail stores like to measure how often inventory turns over…the more turns, the better.

Other businesses, like manufacturers, measure inventory value with the goal of minimizing the amount of inventory in stock.

Why these ratios are important:

Inventory Turnover and Inventory Turn-Days as ratios are important because each day Inventory is held prevents conversion of that Inventory to Cash – thus, said another way, each day that Inventory is held has a cost and the faster Inventory is turned, the more efficient the business and the more Cash it can generate…in this case, $15,728 per day – as shown on the Profit Mastery Assessment page of the Profit Gap Report.

Looking again at the Profit Gap report, it is apparent that this company has a terrific opportunity to increase its working capital by $107,493, as shown in the PMA illustration above. The bottom line is that improvements in inventory turnover increase cash flow, freeing up working capital that can be used for other purposes. Additional “Paybacks” to the company may include:

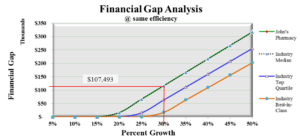

- If it is necessary to borrow money for growth, Profit Gap can be helpful here as well. Go to the Financial Gap analysis page of the report and you may find that growth can be self-funded. In this case, the company can self-fund about 30% growth.

- Optionally, Should the company opt to finance by borrowing funds, a stronger balance sheet will provide increased potential for loan approval.

In summary, the benefits from better inventory management thru use of your Profit Gap report are numerous. A few of the benefits that were touched upon in this article include:

- More liquid assets (cash) available for working capital

- A stronger balance sheet, making it easier to qualify for a loan.

- Improved working capital balances, making it easier to self-finance growth.

Note: The articles regarding working capital illustrate how improved management of Payables, Receivables and Inventory using your Profit Gap reports offer opportunities to increase cash (Working Capital) in your business without increasing sales, or increasing liabilities.

FinancialSoft is dedicated to helping small businesses prosper. Its Financial Reporting Systems provide business intelligence to help company owners increase Cash Flow and Profits thru a better understanding of their financial statements and how to use them to guide company decisions. FinancialSoft Financial Reporting Systems include Profit Gap (Modeled after Profit Mastery teachings) and eFO (electronic Financial Officer). For more information, visit www.financialsoft.biz

Recent Comments