Managing Receivables

This Blog Post is the third in a series about finding Working Capital (cash) in your company thru better management of Inventory, Payables and Receivables.

Managing Receivables

Receivables are an asset found on your Balance Sheet that represents uncollected payments from sales that have already occurred. It is important to note that Receivables are only recognized when you use Accrual Basis accounting.

Receivables are a critical part of cash flow in your business. Most businesses are profitable – that is, they generate a level of sales that is higher than expenses. However, if many of your sales are “on account” and you are billing the customer for payment on terms, this can present a critical challenge to cash flow. Thus, many potentially profitable, growing companies are inhibited by negative cash flow. As a financial professional friend of ours once said: “A growing company has to be careful with receivables – if you are not careful, you can grow yourself right out of business!”

There are many articles available on the importance of managing receivables …just search for Managing Receivables on the Internet and pick one that seems most relevant to your business. Here are a few we thought were good:

http://finance.toolbox.com/blogs/montreal-financial/tips-on-managing-your-accounts-receivable-42717

How your Profit Gap reports can help you:

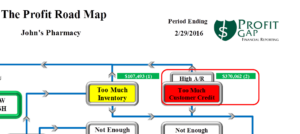

Of interest to us is that all of the articles we viewed validate the importance of paying attention to the metrics included in your Profit Gap reports. Profit Gap reports are actually somewhat like an “early warning” system that helps you identify if you have a problem with receivables. Additionally, the Profit Gap Road Map points you in the right direction for a solution if you find that you do need to take action.

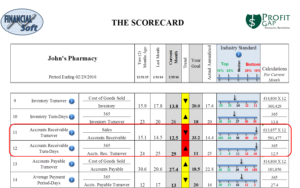

Profit Gap automatically calculates, from your financial statements, how many days on average your receivables have aged. In other words, how long ago did you deliver your goods or services to customers that have not paid your company yet? The financial community will call this metric Accounts Receivable Turn-Days. This is represented in the Profit Gap Scorecard as follows:

The reason this AR metric is important, is that you can monitor your receivable turn days against your customer credit terms and find significant cash opportunities. For example, if your credit terms with your clients are 30 days and you are averaging 45 days of Receivables, that represents 15 days on average over the very terms you gave the client. Any of your customers that are over the 30 day credit terms should be notified and pressured into payment. If you average $50,000 a month on sales that would be calculated as follows:

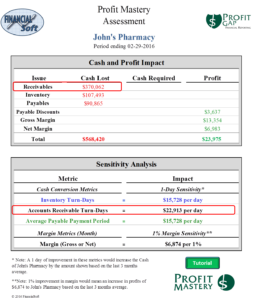

That is $25,000 of cash you would have as additional working capital. If you set your goals to 30 days in Profit Gap, your Profit Gap report will show you your actual Accounts Receivable Turn-Days value on the Scorecard as well as the $25,000 cash opportunity on the Road Map and Profit Mastery Assessment pages of the report. These pages appear as follows:

Profit Gap provides insight into to what your peer companies are doing with their receivable turn days and can provide a good guideline for how you can set terms for your customers.

If your company sells to large companies, it is likely these companies will dictate their own Credit Terms as a condition for selling to them and they will stretch their payments out as far as you will let them. Small businesses should always make sure that if they do a large volume of sales to a large company, that they can live with the long credit terms the large company may demand.

The reality of this sales environment is that the small company will be loaning the larger company the product for the length of the terms. This can significantly increase the small company’s need for additional working capital. Remember, your receivable is their payable and they will most likely try to achieve a negative Cash Conversion Cycle (CCC) as described in the next paragraph.

If The large company is a retailer that manages their inventory tightly, let’s say 15 days, they will sell their products COD so they have no receivables and if they were to get 45 days credit terms from your company as a product supplier, they would have a negative 30 Day Cash Conversion Cycle. Essentially this means that they are running their business with their supplier’s cash… as they have already received the cash from their customer and have not paid the supplier yet for that same product. A great business model for them, but a potentially perilous working capital challenge for a small company.

If you are a Profit Gap Report subscriber just watch your goals and your Scorecard metrics when you run your reports every month and manage accordingly. This advice applies to all three of your Cash Conversion Cycle elements – Inventory, Payables and Receivables.

If you are not a Profit Gap Report subscriber, take advantage of the free trial offer see the advantages of automation for yourself. If you would like to view a copy of a full Profit Gap report, click on the following link: https://financialsoft.biz/wp-content/uploads/2015/06/Profit-Gap-Sample.pdf

If you appreciate the experience, contact FinancialSoft at support@financialsoft.biz for special pricing.

FinancialSoft is dedicated to helping small businesses prosper. Its Financial Reporting Systems provide business intelligence to help company owners increase Cash Flow and Profits thru a better understanding of their financial statements and how to use them to guide company decisions. FinancialSoft Financial Reporting Systems include Profit Gap (Modeled after Profit Mastery teachings) and eFO (electronic Financial Officer). For more information, visit www.financialsoft.biz

Recent Comments