Profit Gap is Financial Analysis at the Click of a Mouse

General

Q: What is Profit Gap?

Q: What are the requirements to get Profit Gap?

Q: Is the Mac OS X version of QuickBooks supported?

Q: What versions of QuickBooks are supported?

Q: Our Company does not use QuickBooks. How can I get Profit Gap?

Q: In installing and running the Profit Gap software I get references to Profit Guard, BRS, Business Resources Services, apps.profitmastery… What are these?

Q: I am not “financially trained” and have not taken any classes to learn about how my financial statements can help me improve my business results, can I still benefit from getting the FinancialSoft Reporting Tool?

Purchase

Q: How do I purchase the Product?

Q: Why Monthly and not Quarterly?

Required Software (QuickBooks Desktop Versions only)

Q: What is the software that I am downloading and installing?

Q: I cannot seem to install the software add-on without my computer Administrator Password. What do I do?

Q: I get warning messages when I install the software – should I be concerned?

Requesting Reports

Q: On my first report, I received a request for my NAICS code – what is that for?

Q: How many reports can a Profit Gap subscriber run each month?

Q: How do I know my data and report request were sent?

Q: When can I expect my report back?

Q: What data is taken from my QuickBooks file?

Q: How is my data protected?

Q: When I prepare to run my second month reports, I see a completely different screen before I upload the data. What is this?

Q: Goals, what are they for?

Q: It appears that my goals were set on my first report. How was that done?

Q: How do I set goals?

Troubleshooting (Desktop Version Only)

Q: I cannot get the software to run. What do I do?

Q: I keep getting the error message stating my QuickBooks are not open and QuickBooks is open. What do I do?

Understanding the Report

Q: I received my first report and I do not get a lot of what it is telling me. Where can I get help?

=====

Q: What is Profit Gap?

A: Profit Gap is a new service that provides customized reports from your company’s QuickBooks Financial data – all with just a few clicks of your mouse! Our feedback indicates that it can take 30 hours or more to manually calculate all the Key Performance Metrics and that is time few business owners are able to regularly invest. Now FinancialSoft will provide you with a monthly report identifying areas for potential financial improvement for your company.

Q: What are the requirements to get Profit Gap?

A: You will need a PC running Windows XP or later. For QuickBooks Desktop a copy of QuickBooks with your company’s financial data and Microsoft Internet Explorer as your browser.

Q: Is QuickBooks for Mac OS X supported?

A: Profit Gap uses software developed by Intuit, supplier of QuickBooks, to extract the required data out of your QuickBooks file. As of this date, Intuit does not support QuickBooks for Mac OS X. Until Intuit develops this software for QuickBooks for Mac OS X, Profit Mastery cannot support Apple MACs

Q: What versions of QuickBooks are supported?

A: Desktop QuickBooks 2008 or later. Online QuickBooks all versions.

Q: Our Company does not use QuickBooks. How can I get Profit Gap?

A: As of today, Intuit’s QuickBooks is the only financial software supported by Profit Gap. QuickBooks dominates the market at a greater than 80% market share of small and medium sized businesses. FinancialSoft will continue to review other financial software packages for inclusion in Profit Gap. If are not on QuickBooks we do have an Excel Spreadsheet we call the Manual Entry Form that you can download and fill in the financial data into the form by copy and pasting your data from your non-QuickBooks software and submit it to use for processing. This is the link for subscribing to that process: CLICK HERE.

Q: I am not “financially trained” and have not taken any classes to learn about how my financial statements can help me improve my business results, can I still benefit from getting the Profit Gap Reporting System?

A: The Profit Gap Reporting System was built to make it easy for people with no financial training to understand and benefit from what their financial statements can tell them.

The main requirement to benefit from the FinancialSoft Reporting System is simply that your business use QuickBooks. Each month, when your books have been closed, simply log into your Profit Gap Reporting System account and get your report.

If you have questions about your report, there are several ways you can get help to understand each page:

- Tutorials: at the bottom of each page in your report you will find a “Tutorial” button. Click on the button and it will open an explanation that explains the entire web page in question.

![]()

- Links: Throughout your report, you will notice (?) icons. Click on these (?) icons for an explanation of that particular term.

- Videos: The FinancialSoft web site will in the future includes videos that explain much of the report content.

Q: In installing and running the Profit Gap software I get references to Profit Guard, BRS, Business Resources Services… What are these?

A: Profit Guard was FinancialSoft’s first automated product. Profit Guard was designing in cooperation with Business Resource Services that teaches a financial class called Profit Mastery. All the software that will be on your computer to collect data from your QuickBooks is common to all our Financial Reporting System of which Profit Gap is one of them. Over time those labels will change to FinancialSoft Financial Reporting System. Rest assured any of these names are correct and will work to Profit Gap.

Q: How do I subscribe to the service?

A: You simply CLICK HERE for QuickBooks Desktop; CLICK HERE for QuickBooks Online; CLICK HERE for non-QuickBook users Manual Entry Form.

Q: Why Monthly and not Quarterly?

A: The most successful companies are those that are on top of their financials regularly. Some think quarterly is enough but in our experience quarterly is okay for purposes of updating your Investors and Stakeholders. However, to reliably identify and track problems on a timely basis, determine the root cause, incorporate corrective action, and review progress – the process is best done monthly. Best practices suggest prompt action – it does not make sense to wait 90 days to see if your corrective actions are working. Profit Gap gives you the ability to easily identify opportunities for improvement and modify corrective actions in 30 days to see if the new plan is working – versus 90 plus 90 or essentially a half a year.

Required Software (QuickBooks Desktop versions only)

Q: What is the software that I am downloading and installing?

A: You are downloading an add-on that Internet Explorer uses to process your report request. Specifically you will be downloading two pieces of software: 1) .NET Framework, a software framework to run the second piece of software, and 2) Profit Guard Data Collector. Once downloaded and installed, Profit Guard Data Collector will be accessed through your Internet browser – Microsoft Internet Explorer.

Q: I cannot seem to install the software add-on without my computer Administrator Password. What do I do?

A: Most computers do not let you install software on them without being the system administrator. You will need your “administrator” or their password to install the software. You will need to have the administrator of your company QuickBooks file open your company’s file. When you run the Profit Guard Data Collector the first time you will see the screen shown below. Check: Yes, whenever this QuickBooks company file is open… On all future runs of Profit Gap you will not need to be the Administrator of the computer nor login as the administrator of the QuickBooks file to be able to run Profit Gap. Please note the Application Calls Itself Profit Guard

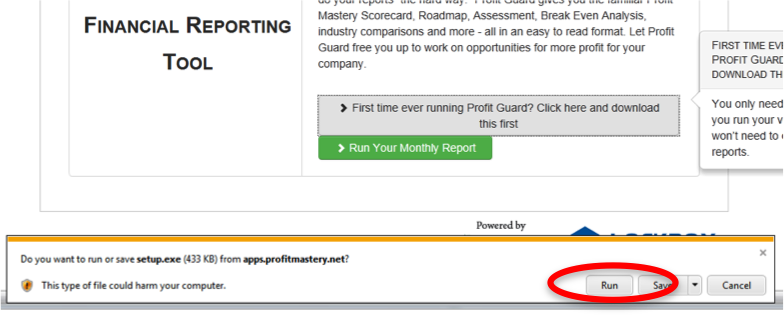

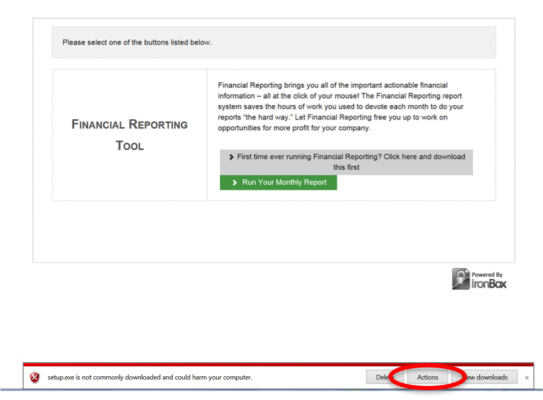

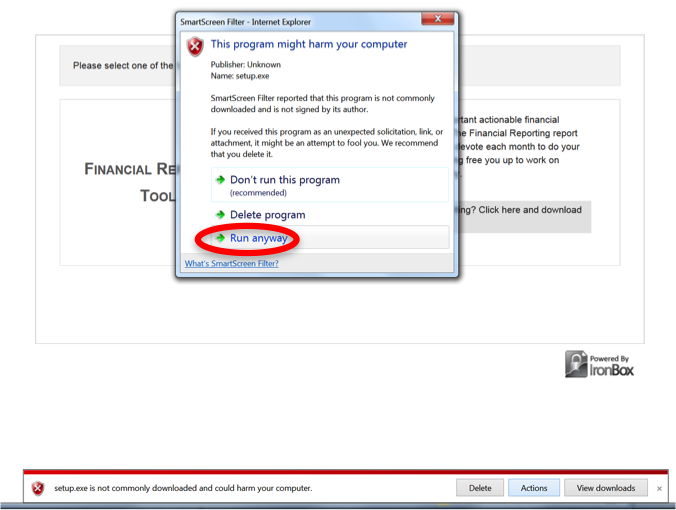

Q: I get warning messages when I install the software – should I be concerned?

A: Installable software usually comes in packages that include the file extension of .exe (Executable Files) or .msi (a component of Windows made for installing programs). Files with these extensions can contain Viruses or Malware that could harm your computer. Either Windows and/or your virus protection software on your computer will warn you of such dangers. In this case you should always select “run” on these messages as the Profit Gap software does not contain anything that will harm your computer. Some of the messages you will see are here:

Select “Run”

Select “Actions”

Select “Run anyway”

Requesting Reports

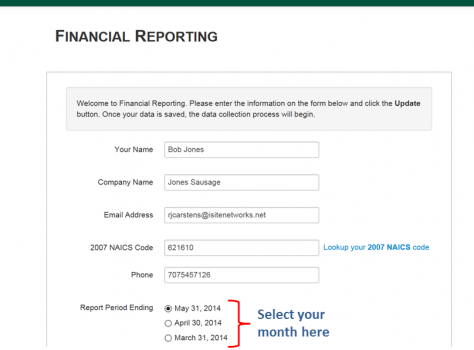

Q: On my first report, I received a request for my NAICS code – what is that for?

A: The North American Industry Classification System or NAICS is used by businesses and the government to classify business establishments according to type of economic activity. We use this code to find comparative data from other business in the same or similar industry type as your company to provide comparable performance metrics.

The NAICS data is given as the average 50 percentile, the top 25% or top quartile, and the top 10% – commonly called “best-in-class.” This data will help guide you when setting your goals. Our desire at FinancialSoft is for your business to succeed. If you strive for best-in-class, we are confident you will drive home the financial results you desire.

Special note on NAICS Codes: If you do not think the Industry Standards on Scorecard reflect realistic numbers for your business we suggest you look up the NAICS code at http://www.census.gov/eos/www/naics and look at what businesses are with your code. Sometimes the NAICS covers too broad a range of businesses to be as meaningful for your particular business.

Q: How many reports can a Profit Gap subscriber run each month?

A: Profit Gap is a once a month activity. If you do not run a report on any given month you can run 2 reports on the next month. You just select which month you would like to run here:

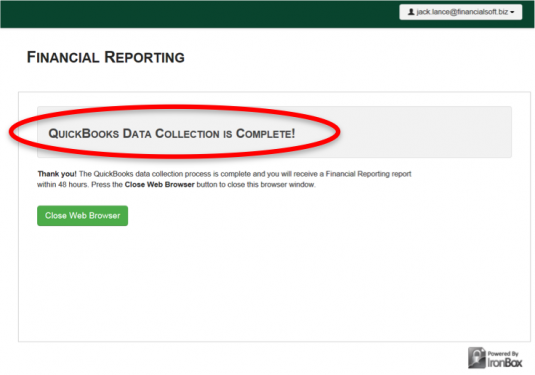

Q: How do I know my data and report request were sent?

A: At the end of the process you will see the following window. This assures you that your data was successfully collected and sent to FinancialSoft for processing.

Q: When can I expect my report back?

A: 10-20 mintues is the turnaround time 24/7. If you do not get the report on the same day you ran it, please contact us at “support@financialsoft.biz”. If there is an issue with your report we will contact you at the email or phone number you provided.

Q: What data is taken from my QuickBooks file?

A: The Profit Gap Data Collector collects your top level Balance Sheet and Income Statement information for the last 13 months. The Profit Gap Data Collector does not collect personal information such as credit card numbers, bank account numbers, or social security numbers. To see exactly what Profit Gap Data Collector sent to Profit Mastery for processing, you can view the collected financial statements after you have run the Profit Gap Data Collector. Simply check the reports that the Profit Gap Data Collector ran within your QuickBooks application.

Q: How is my data protected?

A: Data at rest: Your data is encrypted with a unique Advanced Encryption Standard (AES) 256 bit symmetric key with cipher-block-chaining. A second layer of protection using a Rivest Shamir Adleman (RSA) 3072-bit key is also applied.

Data protected during transmission: Prior to transmission, your data is first protected using the same process described for protecting your data at rest. During transmission your already encrypted data is further protected with a Secure Sockets Layer (SSL) certificate that uses RSA 2048-bit, AES-128 bit (with cipher-block-chaining) and SHA1 protection. Support for weak SSL algorithms, such as v2.0 and lower, PCT 1.0 and all ciphers utilizing MD5, RC4 or weak key-lengths have been disabled at the host.

For more information visit: https://reporting.financialsoft.biz/Account/DataProtection.aspx

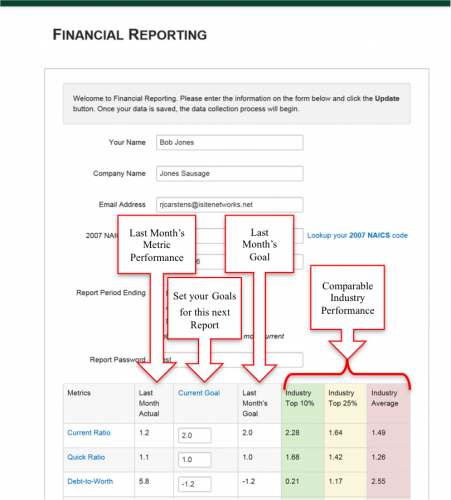

Q: When I prepare to run my second month reports, I see a completely different screen before I upload the data. What is this?

A: For your first month report, we do not ask you to set goals. To simplify the process, Profit Gap sets goals for you on the first report by taking your last month’s performance and improving the number by 20%. In some cases it is 20% larger and in others 20% smaller. There is an exception to this 20% standard for Current and Quick Ratio where we set the goal to 1 if you are more than 20% away from 1. Being at less than 1 on the Current and Quick Ratio can be considered a serious problem.

We then send that data back to your profile stored on our secure server for use on your next month. When you enter the system to request your second monthly report, you will see on the window after your select “Run Your Monthly Report,” a table of data. All of the columns include information to help make your decisions on how to set your goals. To set your goals, you simply overwrite the data in the relevant cell.

Examples are shown in the chart immediately below:

Q: Goals, what are they for?

A: It is critical that all businesses have financial improvement goals. The Profit Gap goals that you set are for the 14 metrics found on the Key Performance Metrics page of your report. The goals are included in the Profit Gap report processes that identify potential Cash and Profit Impacts relative to your actual performance against your goals. These impacts will be shown on the Key Performance Metrics and Financial Flow pages of the report.

Q: It appears that my goals were set on my first report. How was that done?

A: For the first report that you request for your company, the goals are automatically set for you at the top 10% of your industry peers based on the NAICS code you provided. This should be your ultimate goal to be “Best-in-Class” in your industry. When you see your first report it will show you realistic potential for your business.

Q: How do I set goals?

A: That is completely up to you, though we can provide some guidelines. We recommend you look at your last Profit Gap Report. Here are some suggestions:

1) Against industry standards:

a) If you are below the Average 50%, set your goal at the industry standard of 50%.

b) If you are better than the Average 50%, but lower than the Top 25%, set your goal at the Top 25%.

c) If you are better than the Top 25%, but less than the Top 10%, set you goal at the Top 10%.

2) Against your own performance:

a) 10% better than the best of the last 3 months.

b) Equal to the best you have done over the last 13 months.

c) 10% better than the best you have done over the last 13 months.

Troubleshooting (Desktop Version Only)

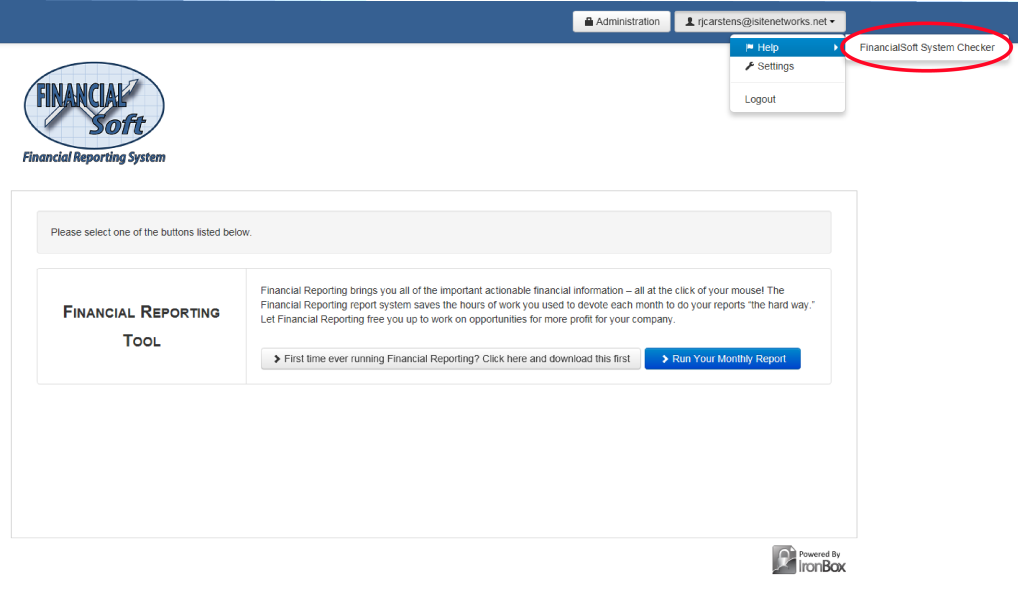

Q: I cannot get the software to run. What do I do?

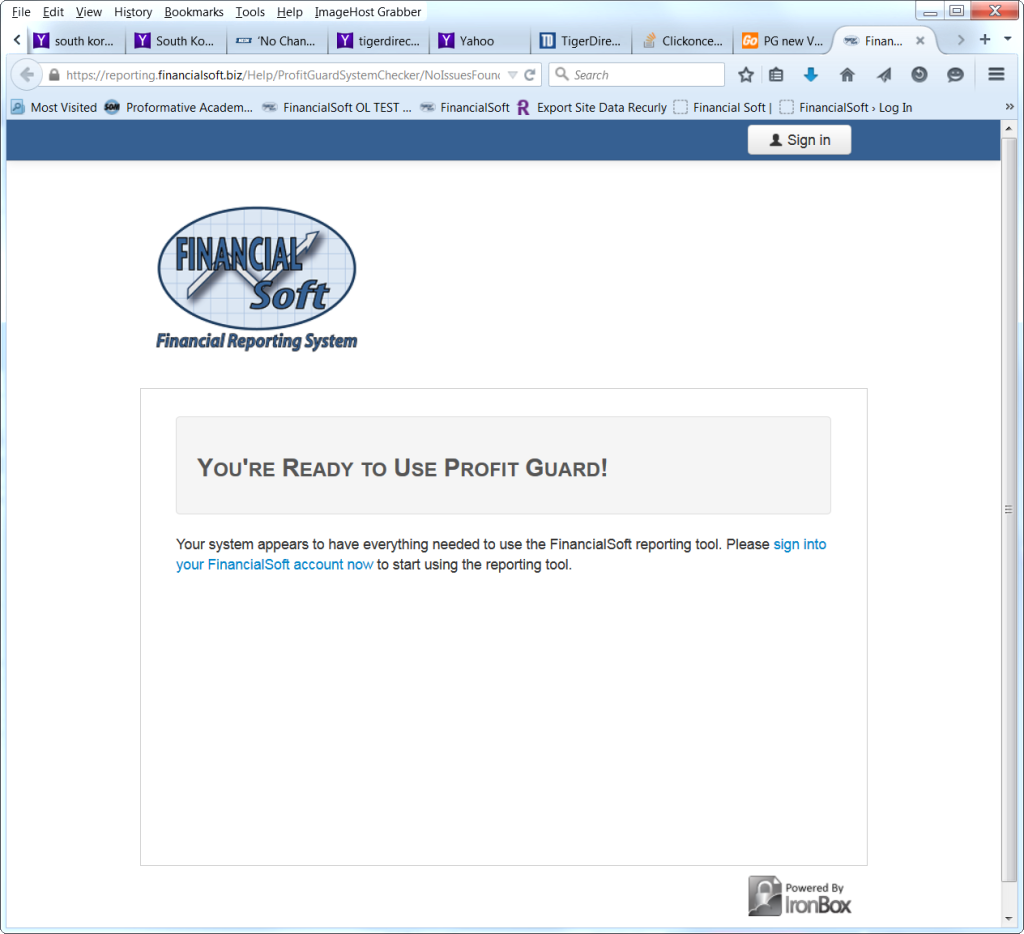

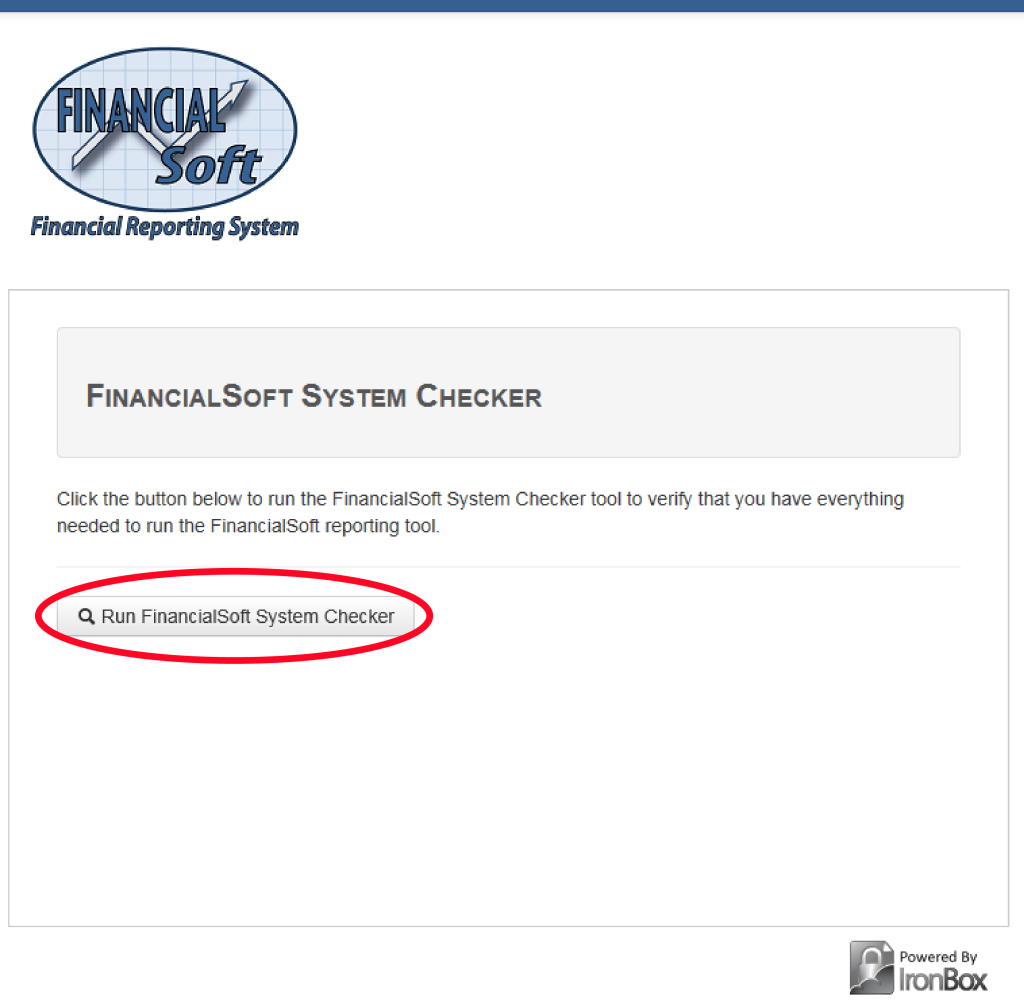

A: We have a diagnostics tool built into Profit Gap that will determine if you have all the software required to run Profit Gap. This tool can be found when you are logged into your Profit Gap account under your name. Select your User ID in the upper right corner of the browser, then Help, then FinancialSoft System Check.

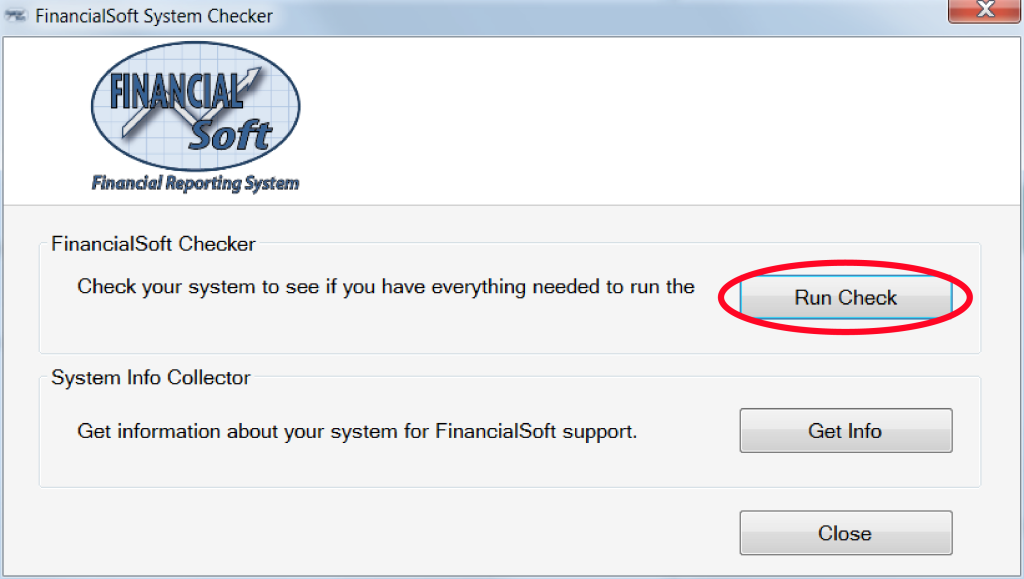

This will be your next screen. Select Run FinancialSoft System Checker.

This will be your next screen. Select Run Check.

This will be your next screen. Select Run Check.

If your computer is ready to go you will get this message:

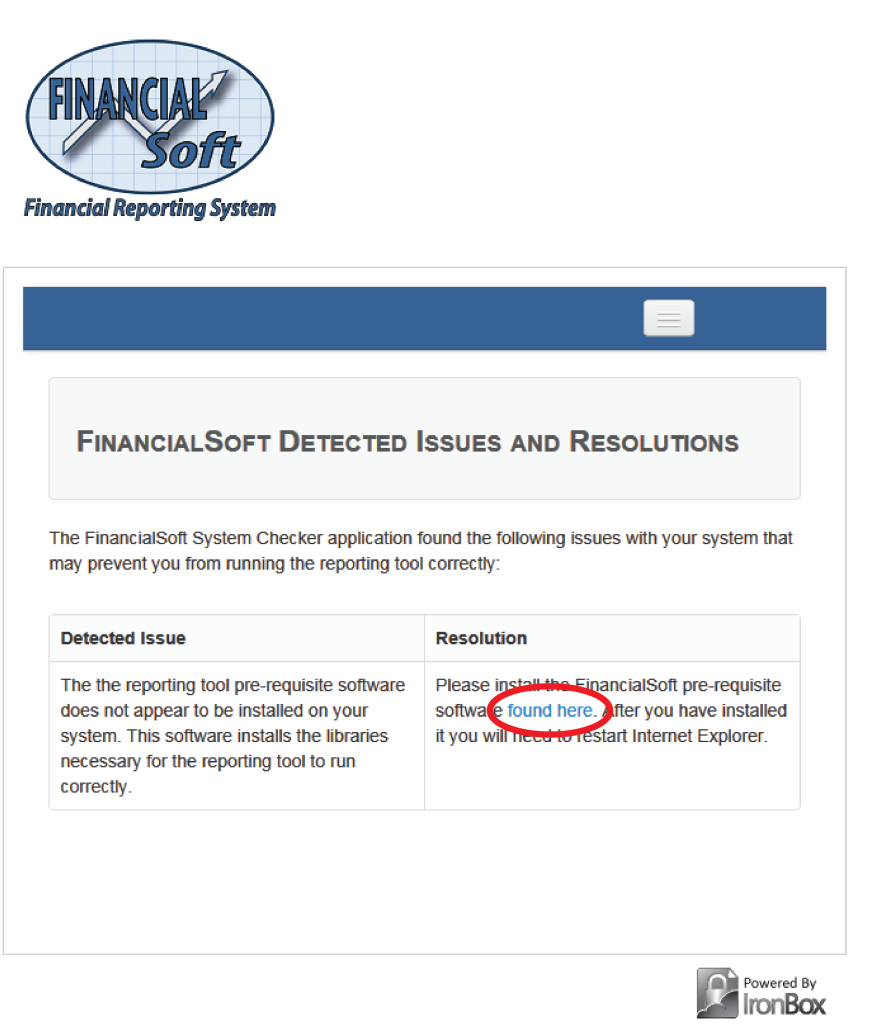

If not you will get this message and you will need to do what is stated on the window by selecting the blue link circled in RED:

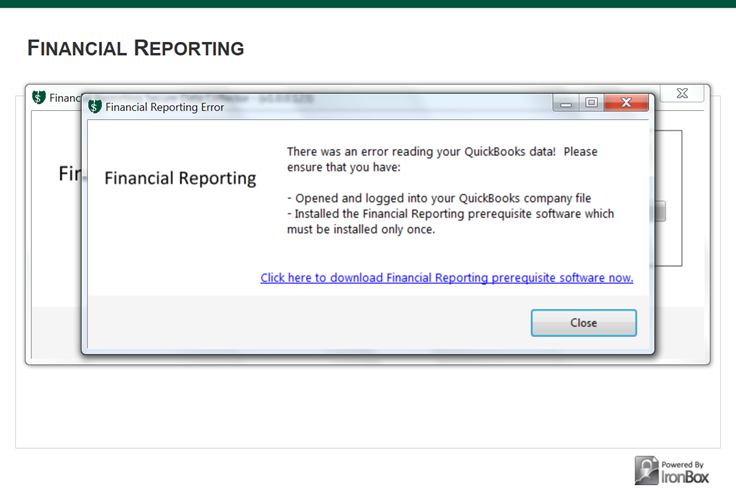

Q: I keep getting the error message stating my QuickBooks are not open and QuickBooks is open. What do I do?

A: If all the required software is running with the QuickBooks Company file open and you still get the error:

The Data Collector is being prevented from communicating with QuickBooks for one or both of the following reasons:

1) On the very first report for a company file, the QuickBooks administrator for that company file must open the company file. Only the administrator can allow an external program to connect with QuickBooks.

If you are logged into QuickBooks as the administrator you will get the following screen from QuickBooks: Select “Yes whenever the QuickBooks company file is open” as shown below.

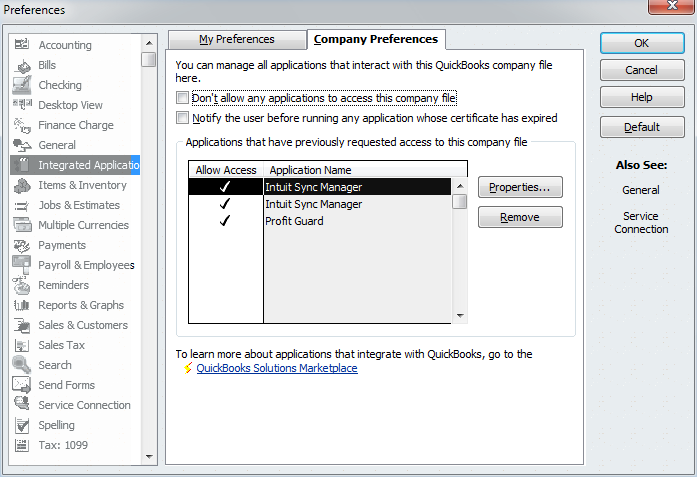

2) If the prior screen does not show up in QuickBooks, the Preferences to allow an external application from communicating with QuickBooks is most likely turned off.

To set the preferences go under QuickBooks Edit menu with the company file open (as the administrator) and select preferences… Under the left column, select “Integrated Applications”. Then in the middle of the window select the Company Preferences tab and uncheck the “Don’t allow any application to access this company file”. Then select OK and run the data collector again. You now should get the QuickBooks – Application with No Certificate. Select the “Yes whenever the QuickBooks company file is open” and the data collector will run. NOTE: The Application Name will be Profit Guard

Understanding the Report

Q: I received my first report and I do not get a lot of what it is telling me. Where can I get help?

A: There are several areas you can get help.

Here are some excellent places:

1) We have downloadable pdf explanations for each page of the Profit Gap Report. Check the pdf links at the bottom of each page of the report.

2) Here is a link to a glossary terms identified with a Blue Question Mark in various places in the report: ![]()