|

|

|

electronic Financial Officer (eFO) was developed by FinancialSoft to provide an easy to understand and use financial reporting system to help maximize profitability for small and medium sized businesses that use QuickBooks.

eFO brings together three key elements to help businesses attain greater cash flow and profitability. This is accomplished with the integration of three specific elements that, when taken together, provide a business with the financial tools and the knowledge to use them in the most effective way possible…tools to help you Learn, Measure, Plan and Manage for success.

Element Number 1: Learn the important keys to profitability

At FinancialSoft, we have learned from experience that MOST people do not understand financial statements, much less how to use them effectively as business management tools. Worse, people are often embarrassed about their lack of financial knowledge so the subject is buried and only briefly addressed at an annual tax meeting with a financial professional.

eFO provides you with Tutorials, a Terminology Glossary and Videos (coming soon) that address and explain all of the elements of your eFO Report. The system is designed for ease of use and understanding. At the end of each month, when your books are closed, simply log into your eFO account and run your report. The report itself includes all of the helpful references needed to understand and implement the strategies you need to focus on to maximize your business profitability.

Element number 2: Measure.

As an eFO user, you will have everything you need to focus on the key financial performance metrics that will help you optimize the financial productivity of your business. eFO is the essential financial report needed for successful business management.

Your eFO report includes the following tools to help you measure the financial success of your business:

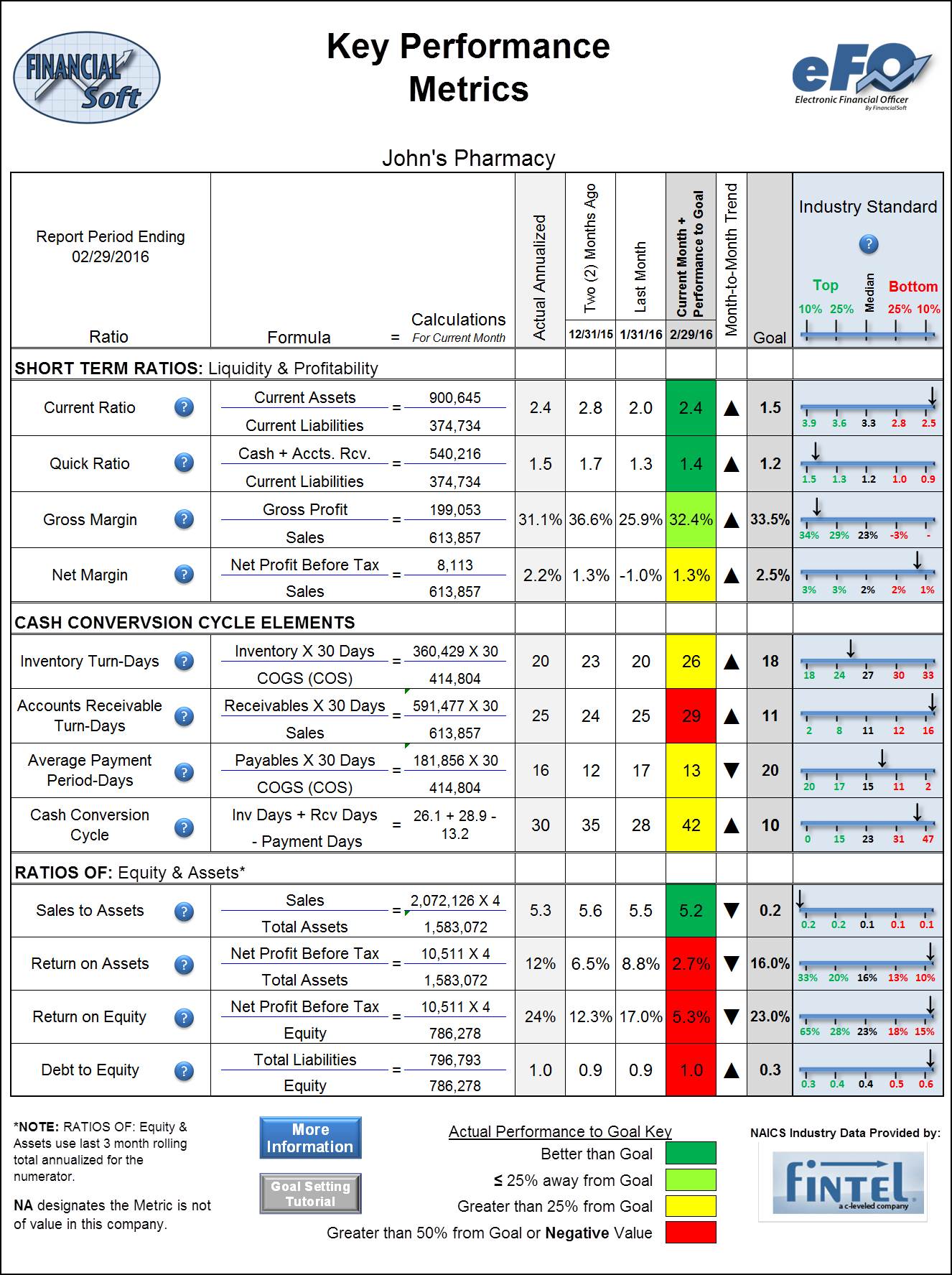

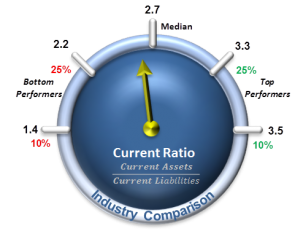

• Key Performance Metrics: powerful metrics that help you focus on opportunities for improvement in the following areas bench-marked against your specific industry:

o Liquidity and Profitability

o How to increase the cash produced by your business

o Sales, debt and equity management

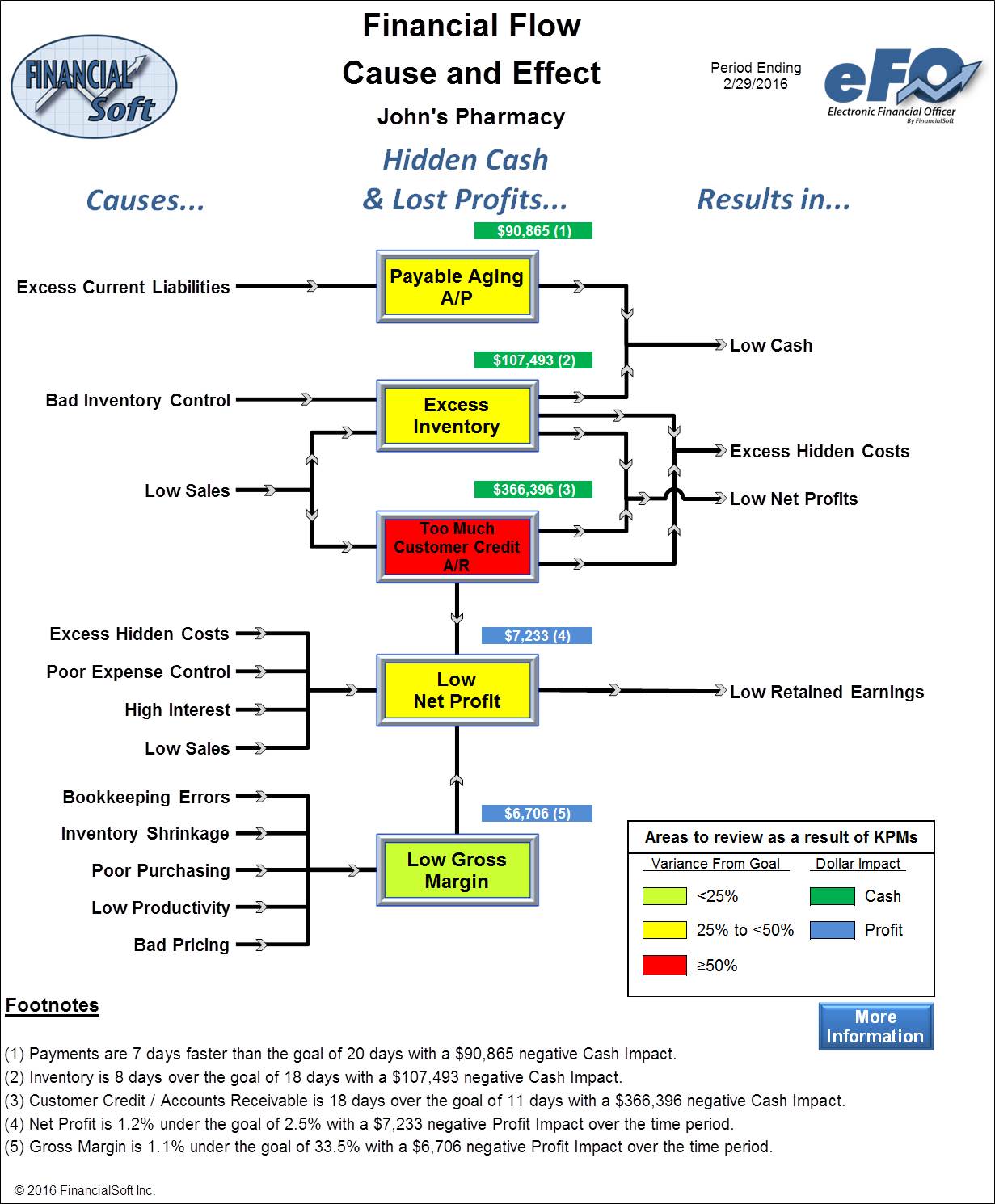

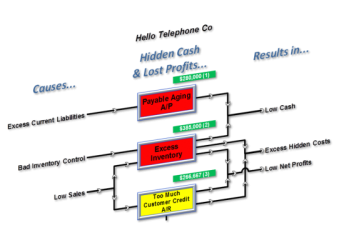

• Financial Flow Cause and effect: Learn where the opportunities for improvement in your business performance are, what causes them and what the effects will likely be.

• Identify Cash and Profit opportunities in your business

o Finds hidden Cash in your business.

o Finds hidden profit opportunities in your business

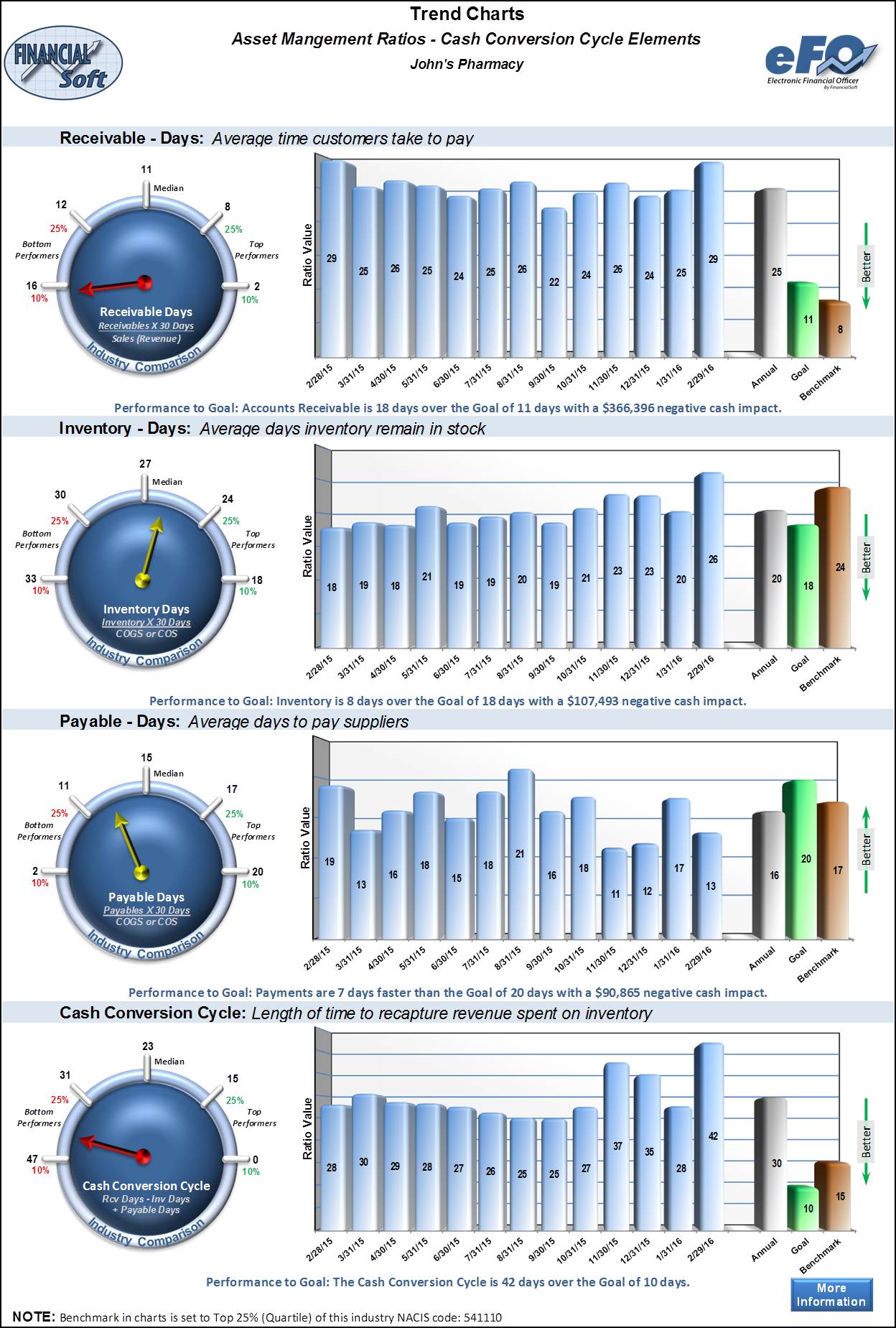

• Trending charts for the Key Performance Metrics that make it easy to track your improvements from month to month.

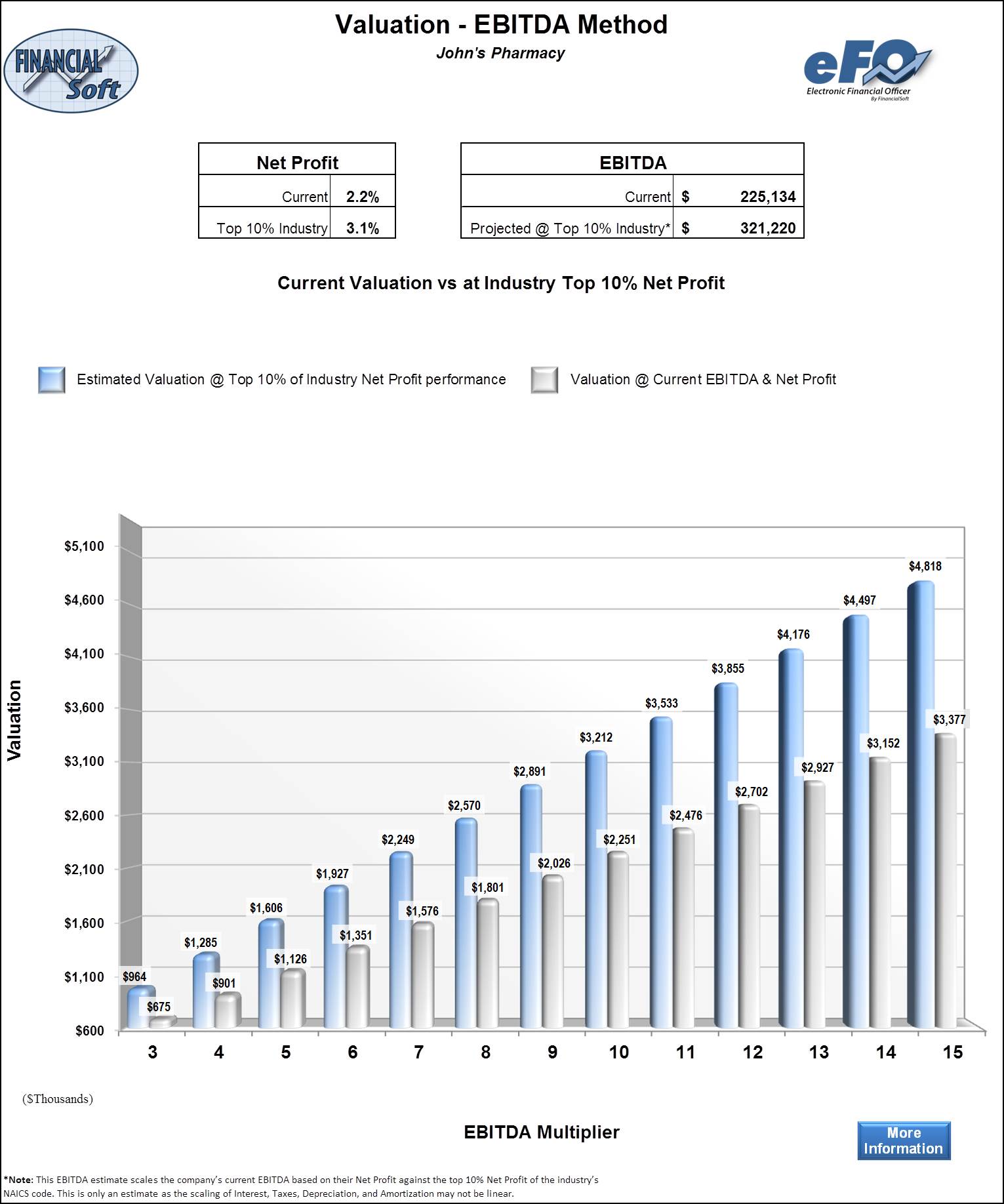

• Planning tools to help you plan for growth of your business including hiring, growing revenue and your business valuation.

Element Number 3: Planning and Management

eFO includes the tools you need to plan and manage your business to optimize profitability. Your eFO reports include easily understood charts that are based on your own numbers from your financial statements that will guide you and help prioritize actions.

View sample eFO report pages below, plus a link for a downloadable complete report at the bottom of this page:

Using QuickBooks Desktop |

Using QuickBooks Online |

Manual Entry(for non-QuickBooks Users) |