Recent world events such as the Coronavirus have created a business environment that is likely to stress many small businesses and customers may practice “social distancing” and stay away for an extended period of time. The result of this latest challenge is that many will be forced to go into debt just to make payroll.

It therefore seems relevant that for this month we focus on Working Capital and debt with an article on the pros and cons of leverage and how your Profit Gap report can help manage Working Capital and Debt with its focus on the Quick Ratio, Current Ratio and our newer addition to Profit Gap of Working Capital metrics.

We added the Working Capital metrics last year for this very situation where your business may take a significant revenue reduction, in this case the spread of the Coronavirus, COVID-19. As stated in an earlier newsletter, having enough Cash to cover your Expenses for such a downturn is critical. The newsletter suggested that during good economic times for your company, you build up your cash reserves before you pay out bonuses.

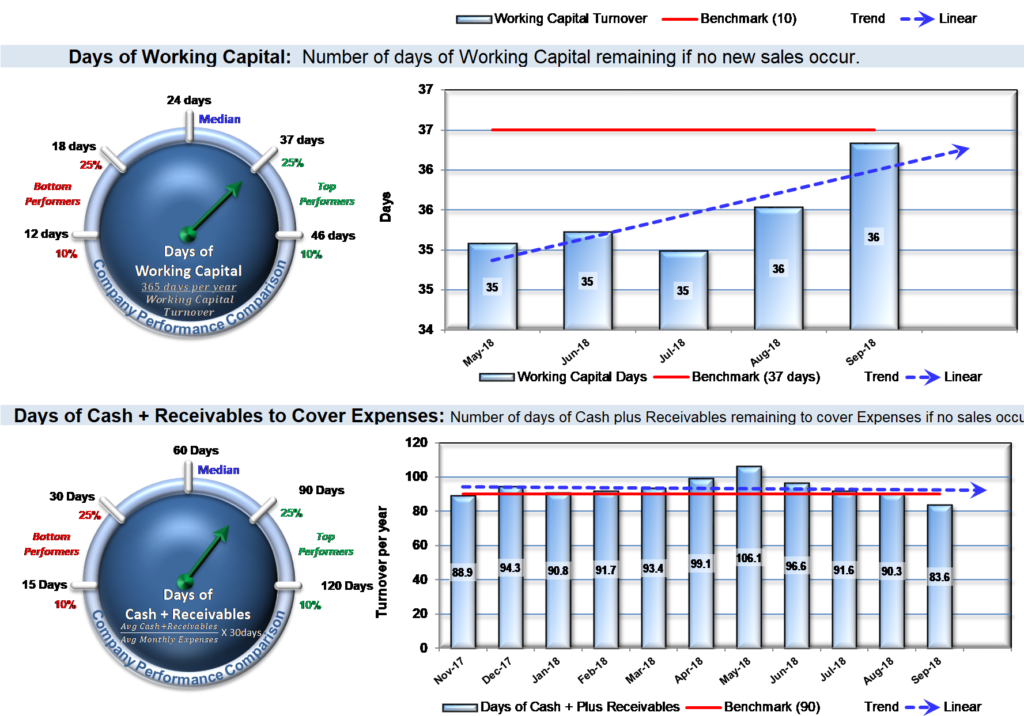

The following two charts are short term measurements on how long a company can sustain low to no revenue. The first chart shows a measure of all your Current Assets against your Current Liabilities. An even more direct calculation is in the second chart where Profit Gap measures Cash and Receivables needed to cover your Expenses, as during a downturn some current assets like Inventory are very difficult to liquidate.

But if you do not have enough Cash to ride out the storm, borrowing money to fill the void might be necessary.

Can you make debt work for you? Every seasoned entrepreneur we have met seems a bit crazed about keeping cash on hand. If you can get them to share their full business experience, there usually is a chapter or more about being burned by leverage … and yet, nearly everyone goes to the well to drink. The details of each story vary. We’ve heard stories that include bank lines of credit, friends and family loans, vendor credit, factoring and even putting a beautiful, classic, well-restored Corvette into a pawnshop to make payroll.

Is your company nimble in the face of an unanticipated financial challenge such as the one presented by the Coronavirus? That nimbleness is the strength of the small business. Adding leverage reduces the flexibility in the face of sudden change, and increases your personal risk by creating additional financial obligations.

In good times, using Debt and carrying high Total Liabilities, relative to the Total Equity, helps earnings grow. But when things turn down, interest payments and debt repayment can add to the challenges.

A high debt load reduces the company’s resilience and increases the risk of a cash crisis in a time of economic stress. The trigger for a crisis may come with an uptick in raw materials costs, a slowdown in sales or a change in the competitive landscape. In the current environment, the challenge is coming from a global pandemic that was sudden and unanticipated.

How much debt is too much? Before the cash crunch, are there any warning signs?

The Quick Ratio and Current Ratio will signal the debt crisis when it is close, and owners should monitor these ratios as closely as their profit margin. But, before any crisis, how much debt does your firm have? We realize that the COVID-19 crisis is already here, but how your company handles debt is relevant in any case. The correct answer has little to do with the dollars owed. The key is the amount owed relative to the assets and equity in the firm.

The key to successfully using leverage to grow a business is not letting this ratio get out of hand. Profit Gap helps the owner monitor this important ratio for the company, and compare it to other firms in the industry.

In this example, this company has more debt than its industry peers. This will make its bankers and lenders wary and unlikely to extend additional credit. But more importantly, the owner will be in lot of pain if things change.

Why is the relevant now? A sudden shock to the economy such as what we are experiencing as a result of the COVID -19 crisis could derail a month or more of sales, or spike raw material prices and could push the company in to a cash shortfall. The average company in this industry uses about 3 to 1 less debt, relative to the size of the equity in the firm. This company, with a Debt-to-Worth (Debt to Equity) ratio in the red at 1.5 is a ticking bomb at risk for a stumble. Even firms in the 75th percentile (the top of the bottom 25% of the industry) use significantly less debt than this company.

Recent Comments