Keeping an eye on Key performance metrics

This letter is particularly relevant to Profit Gap users such as service companies that do not have inventory.

The trend charts in your Profit Gap reports contain information that can be easily overlooked (after all, there are more than 13 charts!) This month we would like to call attention to two particular metrics are especially important to service companies in particular.

These measures help to show how your organization is performing and are key indicators of Cash Flow and financial efficiency. They are measures of how slowly your organization pays its suppliers and how quickly it collects from customers.

As pointed out in the “information” tab on your Profit Gap Report Trends chart page, for companies that do not track inventory, payables and receivables represent major metrics related to your cash flow…the life blood of your organization!

A company can enjoy very good net profits, but still run out of cash if it does not manage these metrics well. Running out of cash is the number 1 reason small businesses fail.

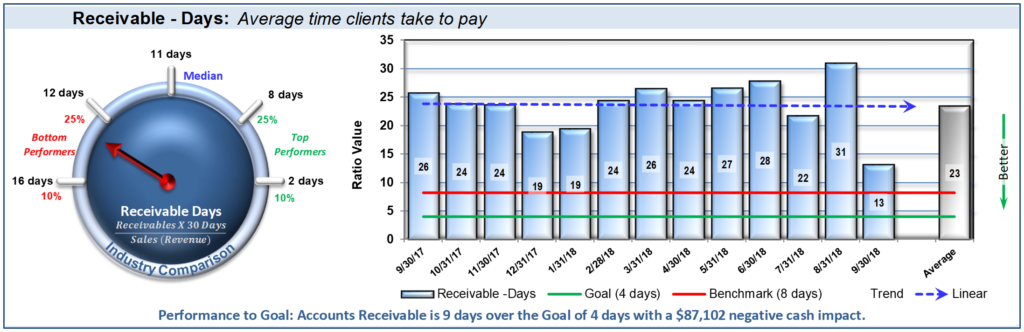

These metrics are found in two places in your Profit Gap report…the Scorecard and in the Trend Charts, later in the report. It can be particularly useful to pay attention the 13-month trend charts that include a bar showing how your company compares with your industry’s top 25% benchmark.

Receivable Days provide a useful measurement for organizational efficiency. If your “receivable days” metric begins to increase, you may need to look carefully at your organization’s debt collection policies. The questions you may want to ask include:

- Are companies taking longer to pay?

- Are particular customers building up a large portion of the total receivables outstanding?

Remember, the older debts become, the more likely they are to go bad. We recommend that if your Receivable Days is higher than you want, just run a Receivable aging report in your QuickBooks™.

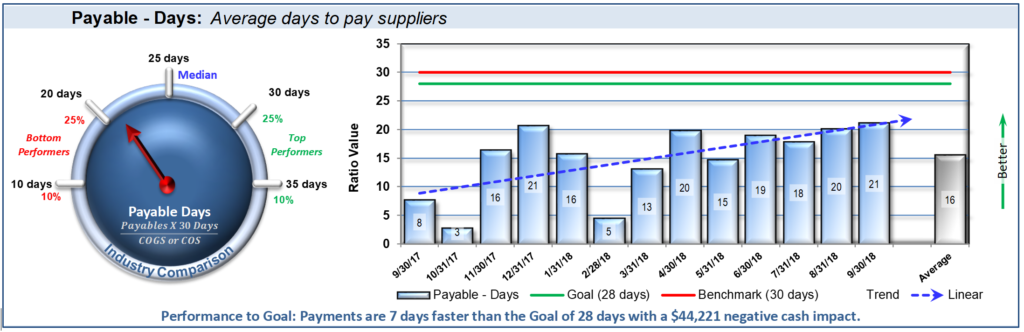

Payable Days…it should be useful to understand how you are paying your suppliers relative to others in your industry.

Usually, it is most prudent to pay no sooner than is required by your credit terms with your suppliers. Typically, small and medium size businesses have a tendency to pay bills as soon as they are received. Our point here is that it is a good strategy to keep your money in YOUR bank account as long as possible…don’t pay any sooner than necessary, if possible.___________________________________________________________________________________________________

Recent Comments