One of the most powerful tools for managing your firm’s liquidity is the credit provided to your firm by your suppliers. Your bank may change your Working Capital Credit Line every 1 to 3 years, but as your business grows so do your purchases with your suppliers. Therefore, your suppliers are typically more responsive to changes in your business. When a firm uses vendor credit, it resides on the Balance Sheet as Accounts Payable within the Current Liabilities.

Liabilities are essentially debt that leverages the owner’s assets in the company. But every liability is a claim on future cash generated by the company. When earnings are positive, using debt such as Accounts Payable increases the financial leverage and increases earnings. But when the economy turns down, or competition increases and sales decline, the debt repayment can add to the challenges.

Accounts Payable is, therefore, a two-edged sword. Vendors, providing the credit, are knowledgeable about your industry – for better or worse. They hear about the industry from multiple sources, including your competitors. To effectively manage and level the playing field, you need to understand your position, debt level and margins relative to your peers. This is where a tool like FinancialSoft’s eFO Report can help.

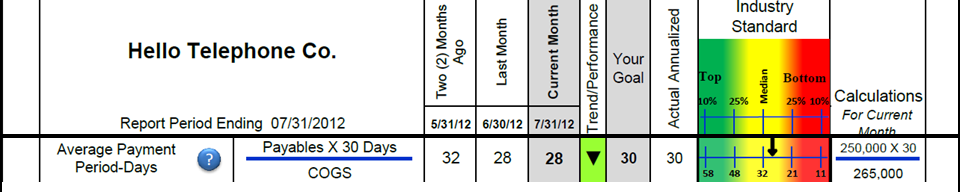

This company is in a position to ask for more credit from its vendors. With this report, it knows that the best in class in its industry probably have 60 day payment terms, and the top 25% of companies in the industry have 45 day payment terms with their suppliers. This company’s Payables, relative to Cost of Goods Sold (which track Revenues) are currently at 28 days. The company is paying its bills four days faster, than the average company in its industry and two days faster than its goals. (Elsewhere in the eFO report, Hello Telephone is told that given the information in QuickBooks for the company, each day of this ratio is worth about $8,000. So that is $32,000 that the company has paid to vendors that could have been retained by the company … if the checks were sent a few days later.)

I’ve seen businesses built on this: Bill Bindley built a multi-billion dollar business (Bindley Western) from a small start, with almost no initial capital. When Bill started his drug distribution business, it was out of his station wagon. Drugstores paid him in 15 days and he paid the drug companies in 30 days – so his firm was started on the “float.”

Keep reading, THIS IS IMPORTANT: Over-maximizing the use of vendor credit, like carrying a high debt load will reduces the company’s resilience and increase the risk of a cash crisis.

Paying as late as permitted is a great strategy for improving a company’s liquidity. But paying a few days later can cause the credit to be reduced.

I once observed a business destroyed this way. An acquaintance purchased an on-line community which was active and had existed for years. It turned a modest profit through advertising and the hosting company had been paid 90 days in arrears for years. There was an address change and the bookkeeper did not notice that the bill had not been paid. The hosting company sent several urgent emails demanding payment, which the tech support team received and ignored. (Their job was primarily clearing the caches and ensuring the community’s bulletin boards were up and running.)

The hosting company, receiving no response, pulled the plug and demanded full payment and a deposit. From their perspective, the new owner was unresponsive. Unlike the prior owner, who had consistently paid, always 90 days late, but every month he paid. The hosting company was confident in their ability to collect their fees from the original owner. The new owner had proven herself unworthy of receiving the same terms.

So, vendor credit works both ways. The wise company owner finds a way to monitor the amount of credit available, how much is being used and how quickly the bills are being paid. The Accounts Payable, expressed in Days of Sales, is a useful way to understand Accounts Payable relative to the size of the business. FinancialSoft’s Reports do the calculations and help owners understand their financial position in a size adjusted way.

Other resources can be found searching the terms Vendor finance, Supply Chain finance and Supplier Credit.

- Supply Chain Finance (Investopedia)

- Using Trade Credit to Fund Expansion (About.com)

For 25 years, Elizabeth Pearce has been a user of accounting information as a professional investor. For years, Pearce has been noticing how difficult it is many successful individuals to grasp nuances in numbers and has come to believe there is a biological component to this communication challenge. She is a Chartered Financial Analyst and holds an MBA from the Haas School of Business at University of California, Berkeley.

Elizabeth, you are right on. Managing Accounts Payable is great way to keep your company’s cash in the company. In my experience many small businesses do not understand this concept and have a tendency to pay as soon as they receive an invoice from a supplier. If you plan as a business owner to maximize your payables you need to stay on top of your payments on a regular basis so you don’t risk that precious credit you have from your suppliers. As long as you stay within the contract limits of payment terms with your suppliers you should have no problem maintaining that credit. But once you’re late many suppliers will reduce your credit and if you’re late on a regular basis may demand future purchases on a COD basis. One thing that I personally experienced is companies that have a reputation of paying late regularly gain a poor reputation and impact other suppliers of the same company to reduce the company’s credit. Bad news travels fast. So as you said working the payables game is a double-edged sword. I would always recommend stretching your payments to the maximum but always make sure you have set reminders in your system never to pay late.

Another trend I’ve seen in the relationship between a company and suppliers is who needs who more. What I mean here is if a small company is buying from a larger company supplier, that supplier will be more aggressive in collecting from that smaller company. But in the other case where the company is larger and is buying from smaller suppliers that larger company can really stretch payments to the max. So it’s always a good policy to select suppliers that really value your business. A supplier that values your business will often be more flexible in payment terms and help you manage your company’s cash more effectively.