Would you like to qualify to a larger loan from a bank?

Do you know what it takes to be an attractive borrower?

Every business owner would like to be more bankable. Most would like to borrow more money to grow their business. An experienced banker once said, “From the point of view of an entrepreneur, a dollar borrowed is a dollar earned … and every dollar repaid is a dollar gone forever.” The first step to getting more credit from your bank or supplier is get them to see your firm from their perspective. Any creditor wants to know, “Will I get repaid?” and “Is this company financially stable?”

To answer these questions, borrowers should be aware that lenders will want to focus on three financial ratios, based on the Balance Sheet. Business owners looking for additional credit would be well advised to know these ratios and their trends for their firm over the past 6 to 12 months.

- Current Ratio

- Quick Ratio (sometimes called the Acid Test)

- Financial Leverage

Most business owners are more familiar with their P&L (Profit and Loss Report) than their Balance Sheet. The Balance Sheet is a basic accounting report which tracks the things that allow the company to function (Assets)and the claims against the resources of the company (Liabilities) and the ownership of the firm. Click here to watch a short investopedia.com video which describes the main components of a Balance Sheet, and how they work together.

The first of the three ratios is the Current Ratio:

The Current Ratio relates the Current Assets (cash, inventory, receivables, and securities) to Current Liabilities (payables, credit cards, working capital lines, promissory notes, and any debt due in the next 12 months).

The Current Ratio relates the Current Assets (cash, inventory, receivables, and securities) to Current Liabilities (payables, credit cards, working capital lines, promissory notes, and any debt due in the next 12 months).

Not all the assets will convert quickly to cash, nor will all the Liabilities need to be paid off soon. A financially healthy firm will have more Current Assets than bills that need to be paid in the next 12 months. Bankers want to see a Current Ratio of 2.0 or more. This means that for every dollar of debt that is coming due in the next 12 months, the company has $2.00 in cash and other assets that will convert to cash in the foreseeable future.

Your banker will be concerned, and your supplier may start to reduce your credit, if this ratio falls below 2.0. They recognize (as should the owner) that risk is increasing and the business may be headed towards a cash crisis in the future.

The second of the three ratios is the Quick Ratio:

While the Current Ratio includes everything that will turn to cash eventually, the Quick Ratio (as the name implies) includes all the Balance Sheet items that are cash, near-cash (liquid securities) or can be sold quickly for cash.

While the Current Ratio includes everything that will turn to cash eventually, the Quick Ratio (as the name implies) includes all the Balance Sheet items that are cash, near-cash (liquid securities) or can be sold quickly for cash.

Firms in need of cash can sometimes sell their receivables (payments due from customers for past sales). If the customers have a history of paying, there are financial firms which will buy the obligations to pay at a discount to a firm specializing in these transactions.

“Factoring” is a form of lending. The discount represents a high interest rate and varies by the perceived risk of non-payment and the length of time until payment is expected. But, generally the factor pays 70% to 85% in advance, and the customer payment is handled through a “Lock Box” – a bank account controlled by the Factoring lender. A Factor might lend 70% today, and charge an interest rate per week. When the client pays, the factor forwards to the company the difference between the 70% prepayment and the interest earned by the factor.

Thus, the Quick Ratio is a measure of the company’s ability to pay its bills. If the Quick Ratio is 1.4, this means that the company has $1.40 in cash or assets that readily convert to cash, for every dollar of debt that needs to be paid within the next 12 months.

Not all Current Liabilities need to be paid off immediately, but since they are they are due fairly soon, the Quick Ratio is a measure of the company’s ability to stay current with its bills. If the ratio falls below 1.0, warning bells should be going off in the mind of the owner. Owners need to monitor the Quick Ratio regularly. As it declines below 1.0, financial risk is increasing and the business is headed towards a liquidity shortfall.

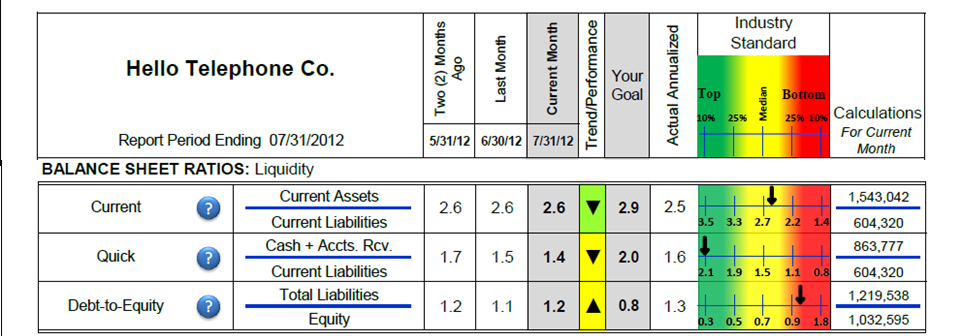

With both the Current Ratio and the Quick Ratio, the absolute number and the trend matter. If you have a high number, say $3 of Current Assets for every dollar of Current Liability, the trend is less important. But if your Current Ratio is less than 2.0 or your Quick Ratio is under 1.0, your lender will want to see improvement. With a tool like FinancialSoft’s eFO (https://financialsoft.biz/electronic-financial-officer/) or Profit Gap (https://financialsoft.biz/profit-gap-2/), you can easily confirm the recent trends and measure improvement over time. See below:

For 25 years, Elizabeth Pearce has been a user of accounting information as a professional investor. For years, Pearce has been noticing how difficult it is many successful individuals to grasp nuances in numbers and has come to believe there is a biological component to this communication challenge. She is a Chartered Financial Analyst and holds an MBA from the Haas School of Business at University of California, Berkeley.

Recent Comments