Can you make debt work for you? Every seasoned entrepreneur I’ve met is a bit crazed about keeping cash on hand. If you can get them to share their full business experience, there usually is a chapter or more about being burned by leverage … and yet, nearly everyone goes to the well to drink. The details of each story vary. I’ve heard stories that include bank lines of credit, friends and family loans, vendor credit, factoring and even putting a beautiful, classic, well-restored Corvette into a pawnshop to make payroll.

Can you make debt work for you? Every seasoned entrepreneur I’ve met is a bit crazed about keeping cash on hand. If you can get them to share their full business experience, there usually is a chapter or more about being burned by leverage … and yet, nearly everyone goes to the well to drink. The details of each story vary. I’ve heard stories that include bank lines of credit, friends and family loans, vendor credit, factoring and even putting a beautiful, classic, well-restored Corvette into a pawnshop to make payroll.

Is your company nimble in the face of change? That nimbleness is the strength of the small business. Adding leverage reduces the flexibility in the face of sudden change, and increases your personal risk by creating additional financial obligations.

In good times, using Debt and carrying high Total Liabilities, relative to the Total Equity, helps earnings grow. But when things turn down, interest payments and debt repayment can add to the challenges. A high debt load reduces the company’s resilience and increases the risk of a cash crisis in a time of economic stress. The trigger for a crisis may come with an uptick in raw materials costs, a slowdown in sales or a change in the competitive landscape.

How much debt is too much? Before the cash crunch, are there any warning signs?

The Quick Ratio and Current Ratio will signal the crisis when it is close, and owners should monitor these ratios as closely as their profit margin. But, before any crisis, how much debt does your firm have? The correct answer has little to do with the dollars owed. The key is the amount owed relative to the assets and equity in the firm.

The Quick Ratio and Current Ratio will signal the crisis when it is close, and owners should monitor these ratios as closely as their profit margin. But, before any crisis, how much debt does your firm have? The correct answer has little to do with the dollars owed. The key is the amount owed relative to the assets and equity in the firm.

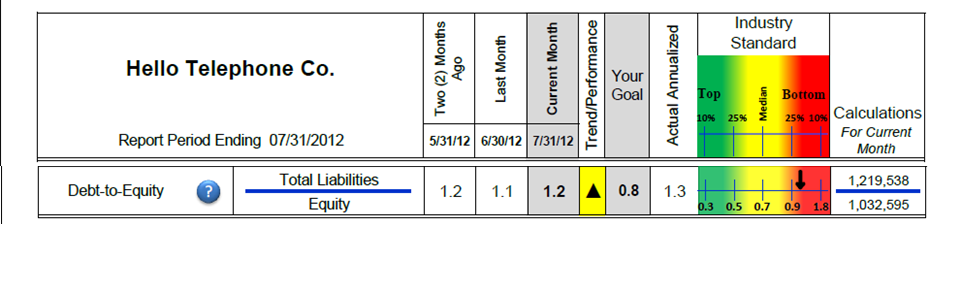

The key to successfully using leverage to grow a business is not letting this ratio get out of hand. FinancialSoft’s eFO Reporting System helps the owner monitor this important ratio for the company and in comparison to other firms in the industry.

In this example, Hello Telephone has significantly more debt than its size-adjusted industry peers. This will make its bankers and lenders wary and unlikely to extend additional credit. But more importantly, the owner will be in lot of pain if things change. A sudden shock to the economy could derail a month or more of sales, or spike in raw material prices could push the company in to a cash shortfall crisis. The average company in this industry uses about 40% less debt, relative to the size of the equity in the firm. This company, with a debt-to-equity ratio in the red (low compared to its industry peers) at 1.2 is a ticking bomb – at risk for a stumble. Even firms in the 75th percentile (the top of the bottom 25% of the industry) use significantly less debt than this company.

For 25 years, Elizabeth Pearce has been a user of accounting information as a professional investor. For years, Pearce has been noticing how difficult it is many successful individuals to grasp nuances in numbers and has come to believe there is a biological component to this communication challenge. She is a Chartered Financial Analyst and holds an MBA from the Haas School of Business at University of California, Berkeley.

Nice article ! Thank you..