March 2017

Profit Gap: Adding value to the Profit Mastery System

Greetings from FinancialSoft,

One of the big questions people naturally ask as they consider subscribing to Profit Gap is “Does it pay off?” Or, what is the…

Return on Investment

Most Profit Gap subscribers have taken the Profit Mastery Class either online or live – which in itself is an investment in their business. Profit Gap provides the easiest way to take advantage of what you learned in the class by doing all the math for you to improve your financial efficiency. But what is the ROI?

One of the great features found in Profit Gap is the ability to find both Cash and Profit opportunities that can readily be used to do a quick Return on Investment (ROI) calculation. For example, if Profit Gap were to identify $20,000 worth of Hidden Cash in your business it would be a “no brainer” as only a small part of $20,000 can pay for a Profit Gap subscription for many years.

The hidden cash element of Profit Gap is based on Receivables, Inventory and Payables levels. For some companies these elements are relatively small and Profit Gap may not find a lot of hidden cash. This is often true of Service type businesses that do not have Inventory. As a result these businesses may not think the ROI of Profit Gap makes sense for them. The reality is that there are many benefits from running Profit Gap reports regularly that help subscribers improve their financial decision making beyond just hidden cash. These benefits can also be monetized to calculate the ROI your subscription.

Over the next few months, I will show you some examples of Profit Gap ROI beyond Hidden Cash and Profits…

- March: Breakeven Analysis

- Making better decisions on Fixed Costs and growing Net Profits

- Understanding the impact of Variable Cost change

- Financial Gap – Improve your probability for approval for a loan

- Scorecard

- Balance Sheet Ratios – Avoid financial disasters

- Income Statement Ratios – Helps manage Pricing & Profitability

- Asset Management ratios – Improve…

- Overall Efficiency

- Cash Flow

- Hidden Cash

- Roadmap – when a problem is found where to go to find the root cause

- Company Valuation – Advance planning, improve the sale price of your business years in advance

Breakeven Analysis

This month I will show you an example of how using the Breakeven Analysis can easily justify the expense of a subscription Profit Gap.

In our discussions with many Profit Gap subscribers, we have learned that the Breakeven Analysis is difficult for some to understand. Thus, one of the best planning tools in Profit Mastery may be underutilized. As usual, Profit Gap does all the calculations for you for your company’s current financial performance so all you have to do is put this powerful tool to use.

For this example, let’s look at one of the biggest desires of all businesses:

Growing Net Profits

The two easiest ways to grow your net profit is to increase sales or reduce your costs. Let’s start with increasing sales.

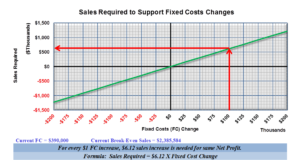

In this example, John’s business currently has 4 sales people. John meets with his sales team and discusses sales increase options. As expected, the sales team believes the best solution is to increase the sales by increasing the available market with a new region and this would be best accomplished by hiring another sales person. This decision would mandate a fixed cost (FC) increase that would occur every year. The plan is to open a small satellite office in the new region of the country where the sales person will run their operation. The total fixed cost increase will be $100,000 annually. John, using the Breakeven Analysis graphs in his Profit Gap report John can determine the gross sales the new sales person will need to get to maintain the same Net Profit. The following is the Breakeven Analysis for John’s decision to increase his fixed costs by $100,000 annually…or not!

John used the graph to determine the sales needed to at least cover the $100,000 expense. John used the graph 2 ways. He first used the graph at a $100,000 Fixed Cost increase and it appears that the remote sales office will need to generate $600,000 in sales to make up for this additional annual expense. He also used the formula of:

Sales Required = $6.12 X Fixed cost change = $6.12 X $100,000 = $612,000

Currently his 4 sales people bring in $588,750 of sales per person. Being that the new sales office would need to bring in more ($612,000 > $588,750) than his current sales people produce just to get to the same Net Profit – John may decide that this is unlikely and opening the new territory is probably not the optimal financial approach for increasing sales.

In getting back to the main point of the Newsletter (Profit Gap ROI), John saved a $612,000 expense by using Profit Gap in his decision making. Certainly a great ROI!

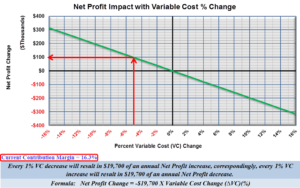

But we are not done yet: As John’s company still has the issue of growing the bottom line and improving Net Profit. The other way John can improve his company’s Net Profit is to reduce his variable cost which will result in additional Gross Profits. And, with no increase in fixed cost expenses, these Gross Profits will flow right to the bottom line and improve the company’s Net Profit. To make this determination, John utilizes the bottom chart of the Breakeven Analysis page of his Profit Gap report:

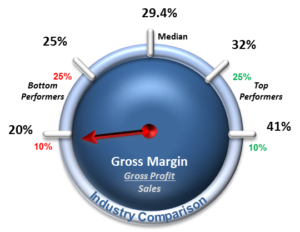

He notices that his Current Contribution Margin is 16.3%. He realizes based on his current Scorecard and Trend Chart that 16.3% is below the Industry Median for Gross Margin.

He talks with his buyers that purchase the materials for their products and they believe with some negotiations a 5% reduction in material will reduce their Variable Costs (VC) by 5%. Once again, John uses the graph above and finds that a 5% VC reduction will add $100,000 to his Net Profit. Using the equation:

Net Profit Change = $19,700 X x% decrease in VC = $19,700 X 5 = $98,500

Fantastic! Another significant ROI as a result of utilizing the tools included in Profit Gap.

By using his Profit Gap tools, John’s decision making process helped him save $612,000 from something he did not do (not bringing on a new sales office), and improved the Net Profit from something he did do that saved him $98,000 when he was able to reduce material costs. Now that is some smart planning on John’s part!

Next month we will show more ways that you can improve your ROI impact from using some of the other tools found in Profit Mastery and Profit Gap.

Bob Carstens

CEO, FinancialSoft

___________________________________________

We value your opinion: Please e-mail us your thoughts, comments or questions regarding your Profit gap report to: support@financialsoft.biz.

Recent Comments